by Paul Hoffmeister, Chief Economist

Some of the biggest surprises of the last year have been the multiple expansion we’ve seen in the S&P 500, as well as the dramatic tightening of credit spreads. During the last 12 months (through March 2024), S&P 500 earnings have grown approximately 6.8% while the stock index has rallied nearly 27%. As a result, the S&P’s price-to-earnings ratio has climbed four points from almost 19x to 23x. At the same time, the spread between Moody’s Baa and Aaa-rated bonds has narrowed from approximately 120 basis points to 75 today. This spread shows the difference in what investors demand in compensation for loaning money to companies with moderate credit risk and those with the highest credit quality. Both indicate massive risk appetites among investors today.

This multiple expansion and credit tightening is quite remarkable, historically speaking. Since 1993, the average P/E ratio for the S&P 500 has been 18.7 whereas the tightest that the Baa-Aaa spread tends to get is somewhere between 55 and 75 basis points. Today, stocks are meaningfully more expensive than usual, and credit markets are in a zone typical of some of our best economic periods.

To be sure, the market multiple has been higher in the past and credit spreads have been a little tighter. And, it’s arguably a stretch to say that the market is priced for perfection. But financial markets are pricing in A LOT of optimism. It very well could be that the market believes that Jerome Powell and Co. are successfully threading the needle, by modulating interest rates in almost perfect harmony with the economy. And it could be that investors today are expecting the current Fed pause and possible rate cuts later this year will enable growth to continue or even improve, while at the same allowing inflation to drift lower to the Fed’s 2% target.

What makes today’s “market exuberance” so surprising is the breadth and magnitude of the risks that we see: Ukraine, the Middle East (Hamas, Hezbollah, Iran), commercial real estate, bank challenges, recently higher-than-expected inflation, the federal deficit, and interest costs on the national debt that are about to seemingly explode. Indeed, these risks could subside, and market optimism today could be justified. Notwithstanding, it seems that a lot of things need to go right for risk assets to maintain current price levels and appreciate further.

In the current opportunity set between stocks and bonds, we believe Treasury bonds are more attractive than stocks. Thanks to years of the Fed pushing up Treasury yields and investors recently marking up the value of equities, we face a somewhat unusual situation where the 10-year Treasury is yielding almost what the S&P 500 is yielding.

At a 22.8 P/E ratio, the earnings yield for the S&P 500 is 4.39%. Meanwhile, the 10-year Treasury yield is yielding approximately 4.35%. This means that there is less than 5 basis points in equity risk premium today. The average has been 2.4% since 2000. Today’s low equity risk premium underscores how expensive stocks are today and how little equity investors are being paid to take on equity risk. As we see it, equity investors will need earnings to grow meaningfully in order to generate sizeable returns in the coming years. That’s if, of course, today’s known and unknown risks don’t materialize.

DIAL IN FOR OUR QUARTERLY

EVENT-DRIVEN CALL

3rd Wednesday of every quarter at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B551

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

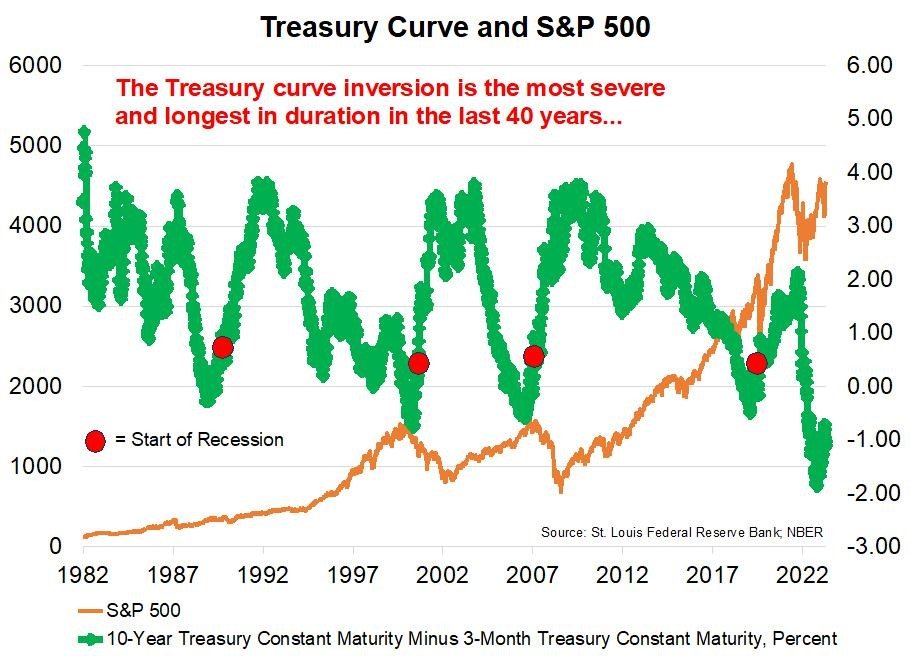

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2024 Camelot Event-Driven Advisors, All rights reserved.