Brexit Uncertainty; Trump Wins in 2020?

By Paul Hoffmeister, Chief Economist

April Commentary

· New information in March regarding both the Brexit situation and the Mueller investigation caused, in our view, some choppiness in financial markets, but overall, the information appeared to be a net positive.

· With the Mueller investigation concluded and the Brexit variable evolving favorably for markets, the S&P 500 could easily break its September 20 closing price of 2930.75 in the coming days or weeks; especially with the Fed seemingly no longer threatening to raise interest rates.

· For us to be increasingly comfortable about the risk environment in coming months, we particularly want to see credit spreads continue to narrow and the Treasury curve steepen. In our view, this would signal that underlying economic and financial variables were rebounding from the late 2018 economic weakness. Recent better-than-expected manufacturing data might be pointing to such a scenario.

· At the moment, it appears a Trump impeachment is no longer a possibility, and the political outlook will be more centered on the 2020 election cycle. Will President Trump be re-elected? Will the trend of tax cuts and deregulation continue – not to mention the pressure on the Fed to refrain from anti-growth interest rate increases? Or will Democrats regain control of the executive branch and Senate, and change the economic policy trajectory? These are some of the questions facing investors.

· As we outline in this letter, President Trump will likely be re-elected next year given the improved economy of the last two years, his campaign infrastructure, and his approach to campaigning. But his biggest risk could be the economy, especially within the context of the flat/inverted Treasury curve today, which is signaling potential dangers on the horizon.

Macro Developments in March

As we laid out in our client letter last month, we’ve been constructive about the medium-term outlook for equities and other risk assets. But we expected to see near-term market volatility as some of the major macro variables get sorted out, such as Brexit, US-China trade, and political questions in the United States. New information in March regarding both the Brexit situation and the Mueller investigation caused, in our view, some choppiness in financial markets, but overall, the information appeared to be a net positive.

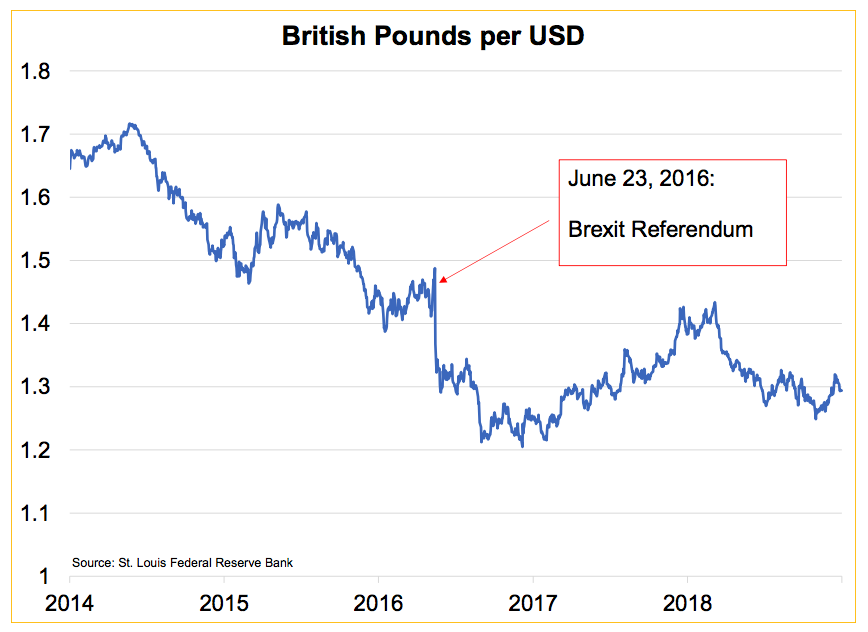

Looking back at the last month, the UK’s March 29 deadline to leave the EU came and went, without a divorce. While it’s still unclear how this variable will play out (it’s a highly fluid situation), it appears that a sudden, no deal Brexit will be avoided. Additionally, special counsel Robert Mueller submitted the report of his investigation to Attorney General Barr, finding that there was no proof of collusion between President Trump and Russia.[1]

At the moment, it appears a Trump impeachment is no longer a possibility, and the political outlook will be more centered on the 2020 election cycle.

As for Brexit, we believe our statement last month still holds true: “…the Brexit variable is a complicated mess with no one in the world, not even Prime Minister Theresa May, certain how it’ll exactly play out.”

While the UK House of Commons rejected Prime Minister May’s backstop plan for the third time on March 29, the EU pushed back the Brexit deadline to April 12 if a majority of the Parliament doesn’t soon agree on a plan. If a plan is, however, agreed upon, the deadline will be postponed to May 22.[2]

What comes next is still highly uncertain. At the moment, Prime Minister May has reached out to opposition party leader Jeremy Corbyn to forge a compromise between the Conservative and Labour parties. May has reaffirmed that she does not want a no deal Brexit scenario, and it therefore looks as though either a soft deal Brexit plan will be reached (such as a customs union scheme) or a long extension will be requested from the EU.

That said, a no-deal Brexit could still occur in the coming weeks, given the widespread disagreement in Parliament on this issue. Although we don’t believe that a no-deal Brexit would be necessarily catastrophic were it to occur (immediate, pro-growth options could be pursued), the current outlook of a “soft” Brexit or long extension appears to be most friendly to markets during the near-term.

With the Mueller investigation concluded and the Brexit variable evolving favorably for markets, the S&P 500 could easily break its September 20 closing price of 2930.75 in the coming days or weeks; especially with the Fed seemingly no longer threatening to raise interest rates. If anything, investors view a rate cut more likely than an increase. According to the Chicago Mercantile Exchange on April 1, the market expected no chance of a rate increase by year-end, and a 58.3% probability of a rate cut.

For us to be increasingly comfortable about the risk environment in coming months, we particularly want to see credit spreads continue to narrow and the Treasury curve steepen. In our view, this would signal that underlying economic and financial variables were rebounding from the late 2018 economic weakness. Recent better-than-expected manufacturing data might be pointing to such a scenario.

According to the St. Louis Federal Reserve, the spread between 10-year and 3-month Treasuries was only +1 basis point at the end of March, indicating the highest risk of recession than we’ve seen in almost a decade. Based on the spread of 24 basis points at the end of February 2019, the New York Federal Reserve was estimating a 24.62% probability of recession within the next 12 months.

We do not yet expect a recession during the next two quarters, but further inversion of the yield curve will signal to us that a strong slowdown or even recession could occur late this year or next.

Thinking about the 2020 Elections

During the next year and a half, we will be closely following U.S. political trends and their potential impact on the economy and financial markets.

Of course, politics impact policy. Will President Trump be re-elected? Will the trend of tax cuts and deregulation continue – not to mention the pressure on the Fed to refrain from anti-growth interest rate increases? Or will Democrats regain control of the executive branch and Senate, and change the economic policy trajectory? These are some of the questions facing investors.

Some of the major policy positions put forth by Democrats in recent months are “Medicare for All” (by Bernie Sanders), the “Green New Deal” (by Alexandria Ocasio-Cortez), and annually paying taxes on unrealized capital gains (by Ron Wyden).[3]

In a recent Wall Street Journal opinion column, Brookings senior fellow William Galston argued that Democrats could win in 2020 by either focusing on the Southern and Sunbelt states (namely North Carolina, Florida, Georgia, Arizona and Texas) with a progressive candidate, or on the “blue wall” states (Wisconsin, Michigan and Pennsylvania) with a more moderate nominee.[4]

It increasingly looks like the 2020 presidential contest will be decided by the blue wall states because that’s where Democrats seem to have the best chance of victory.

As Galston put it, President Trump’s approval ratings are generally higher in the Southern/Sunbelt states; Democrats hold a relatively better party-ID advantage in the blue wall; and in those blue wall states, Democrats won all six statewide elections in 2018, whereas they lost six of seven statewide races in the Southern/Sunbelt states.[5]

This electoral dynamic helps to explain the growing demand for former Vice President Joe Biden to enter the race. For example, according to last month’s Des Moines Register/CNN/Mediacom Iowa Poll, Biden was the first choice of likely Democratic caucus-goers.[6] Although Biden hasn’t officially announced his candidacy, rumor has it he will run.

Biden’s VP role in the Obama Administration and his Scranton, PA roots create, as William McGurn highlighted last month, a potentially formidable combination that could “bridge the growing gap between the principal elements of the winning Obama coalition—women, racial minorities, wealthy white liberals and the young—and the working-class white voters who live in key battleground states, who voted for Mr. Obama in 2012 but who bolted for Mr. Trump in 2016.” [7]

The centrality of the blue wall in 2020 also explains why massive investments are being made in Wisconsin, Michigan, Pennsylvania and Florida by both Democratic and Republican groups. According to the Wall Street Journal, Democratic Super PAC, Priorities USA, announced a $100 million spending plan in these states, and the Trump campaign, which raised more than $100 million last year, plans to spend heavily in those states as well.[8]

For his part, President Trump doesn’t look necessarily weak. In addition to the relatively strong economy and historically low unemployment rate, his re-election campaign may be the strongest of its kind in history.

In their recent in-depth look into Trump’s 2020 campaign, CNN’s Jeremy Diamond, Dana Bash and Fredreka Schouten suggest that it’s a “presidential re-election campaign unlike any other at this early stage.”[9] The campaign’s strengths are rooted in best-in-class data analytics, strong field operations, and never-seen-before fundraising and advertising.

Key to the Trump infrastructure is the fact that the Republican National Committee and the Trump campaign have merged their field operations and fundraising efforts. Now, Republicans – who were outmatched in 2008 and 2012 -- have better voter data and targeting capabilities than Democrats.[10] The importance of data and targeting is underscored by the fact that Brad Parscale, a former digital marketing executive and Trump’s 2016 digital director, is this year’s campaign manager.

And this competitive advantage will be leveraged in a big way, as Trump’s re-election campaign has raised and spent more money than any other re-election campaign at this point in the cycle. According to Axios, the Trump campaign has spent year-to-date through March 10th nearly twice as much as all the Democratic presidential candidates combined on Facebook and Google Ads.[11]

This combination of data supremacy and deep pockets could be an insurmountable advantage if Democrats cannot quickly catch up during the next 12 months. Former Governor Howard Dean has been tasked with getting the DNC’s data infrastructure and analytics quickly up to speed.[12]

Some recent polling also bodes well for the President. According to a recent Wall Street Journal/NBC News poll, Trump’s approval rating is 46%, similar to that of Presidents Clinton and Obama at this point in their first terms.[13] Even more, Trump cumulatively leads a generic Democrat opponent 46% to 40% in Indiana, Michigan, Ohio, Wisconsin and Pennsylvania.[14]

In addition to his impressive infrastructure, Trump also has, as the 2016 elections proved, his unique and effective campaigning style that quickly catapulted a political outsider to the presidency. Trump’s tactics in the coming year might not change too much. Vanity Fair’s Bess Levin reported in February that President Trump is already testing new labels and nicknames for his opponents, in anticipation of the general election.[15] This kind of “opponent branding” coupled with Trump’s ability to leverage social media like no previous president will be hard to counter. Needless to say, it will be interesting to see how Democrats choose to combat Trump’s tactics this time around.

I’d suggest that President Trump will very likely be re-elected next year given the improved economy of the last two years, his campaign infrastructure, and his approach to campaigning. But his biggest risk could be the economy, especially within the context of the flat/inverted Treasury curve today, which is signaling potential dangers on the horizon.

As a result, to bolster his economic credentials, it’s likely during the next 12 to 18 months that President Trump will continue to emphasize his objections to Fed policy, demand further tax relief and reciprocal trade agreements, and pivot to the political center on matters related to the social safety net, notably healthcare and entitlements; while attempting to brand Democrats as the party of socialism (think Venezuela). Politics is a combat sport. This election cycle should prove that once again.

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

*******

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

[1] “Mueller Finds No Proof Trump Collusion with Russia; AG Barr says evidence ‘Not Sufficient’ to Prosecute”, by Pete Williams, Julia Ainsley, Gregg Birnbaum, March 25, 2019, NBC News.

[2] EU Approves Brexit Extension, But Chaotic Departure Still Looms”, by Stephen Castle and Steven Erlanger, March 21, 2019, New York Times.

[3] “Key Democrat Revives Plan to Make Capital Gains Tax Due Annually”, by Laura Davison and Lynnley Browning, April 2, 2019, Bloomberg.

[4] “Two Ways Democrats Can Win in 2020”, by William Galston, February 26, 2019, Wall Street Journal.

[5] Ibid.

[6] “Iowa Poll: Not Even in the Race, Joe Biden Leads Herd of Democrats; Bernie Sanders Close Behind”, by Brianne Pfannenstiel, March 9, 2019, Des Moines Register.

[7] “The Case for Joe Biden”, by William McGurn, March 11, 2019, Wall Street Journal.

[8] “Democratic Big Money Flows into Four Key States”, by Julie Bykowicz, March 14, 2019, Wall Street Journal.

[9] “Money, Power and Data: Inside Trump’s Re-Election Machine”, by Jeremy Diamond, Dana Bash and Fredreka Schouten, March 19, 2019, CNN.

[11] “Another Trump Facebook Election”, by Sara Fischer, Mary 19, 2019, Axios.

[12] “Money, Power and Data: Inside Trump’s Re-election Machine,” by Jeremy Diamond, Dana Bash and Fredreka Schouten, March 19, 2019, CNN.

[13] “Trump’s Job Approval Rating Ticks Up, Along with Warning Signs”, by Reid Epstein, March 3, 2019, Wall Street Journal.

[14] Ibid.

[15] “Trump Workshopping Strategy to Psychologically Devastate Opponents”, by Bess Levin, February 19, 2019, Vanity Fair.