by Paul Hoffmeister, Portfolio Manager and Chief Economist

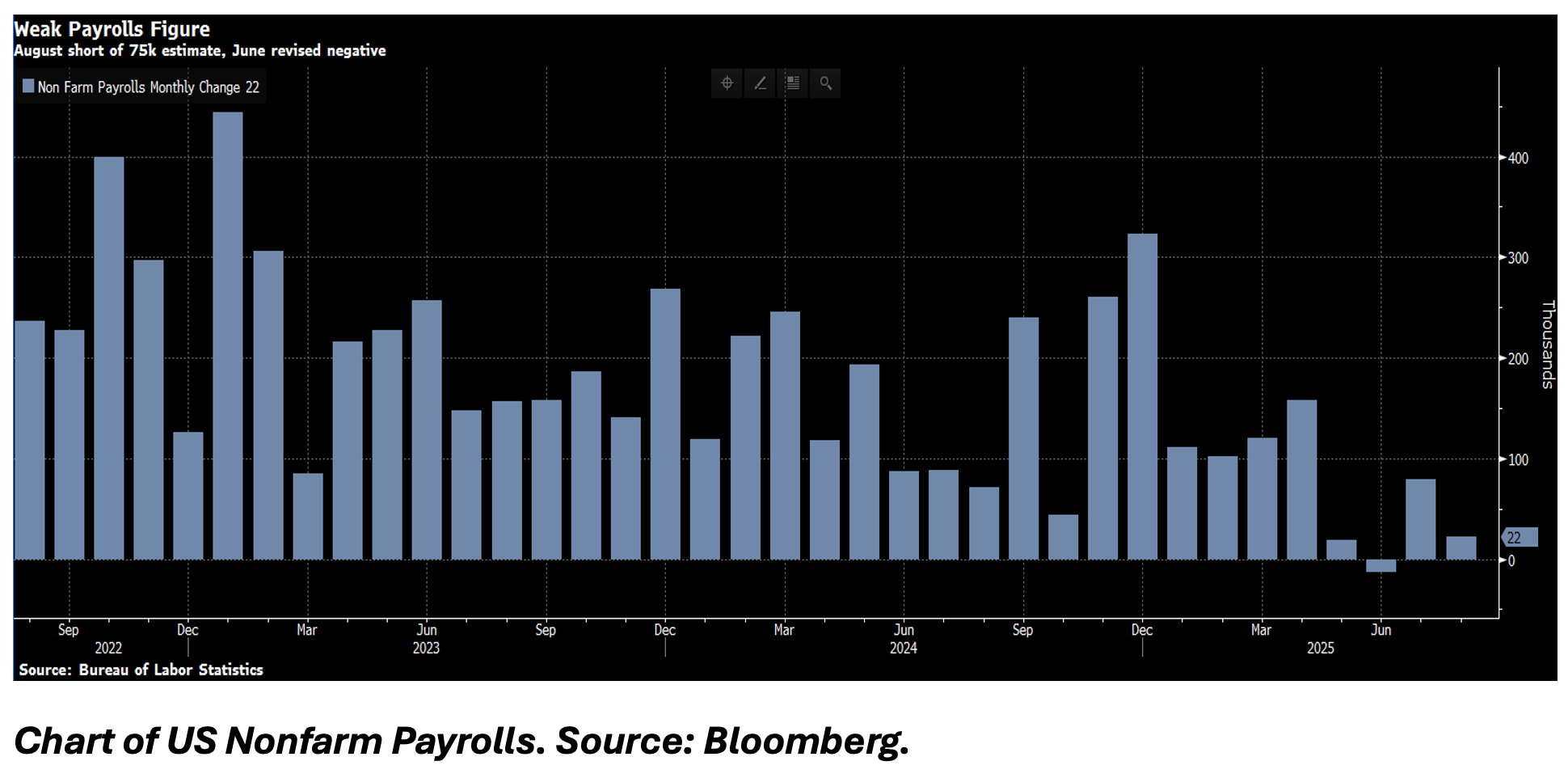

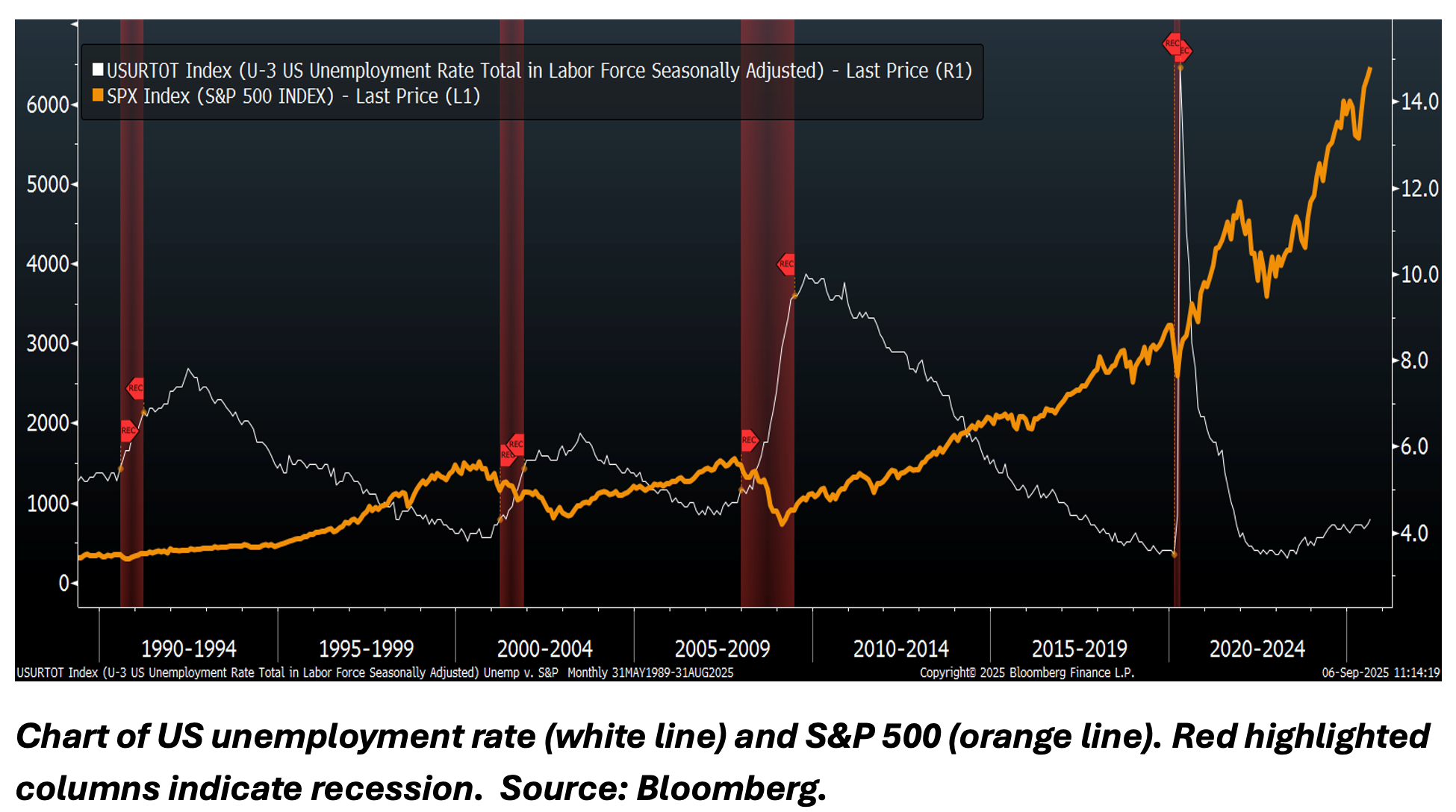

Last Friday, the nonfarm payrolls report from the Bureau of Labor Statistics revealed that cracks in the labor market are starting to appear. Specifically, only 22,000 jobs were created in August; this compared to about 168,000 per month in 2024. At the same time, the unemployment rate rose to 4.3%, up from a cycle low of 3.5% during Q3 2022. Excluding the Covid pandemic, job growth last month was the lowest since 2010. Although nearly 31,000 jobs were added in the health care sector, job losses occurred in information, business services, financial activities, manufacturing and the federal government sectors. Then on Tuesday morning, the Bureau of Labor Statistics announced that the number of workers on payrolls for the twelve months ended March 2025 will likely be revised lower by over 900,000. The news further makes the case that the labor market is slowing meaningfully.

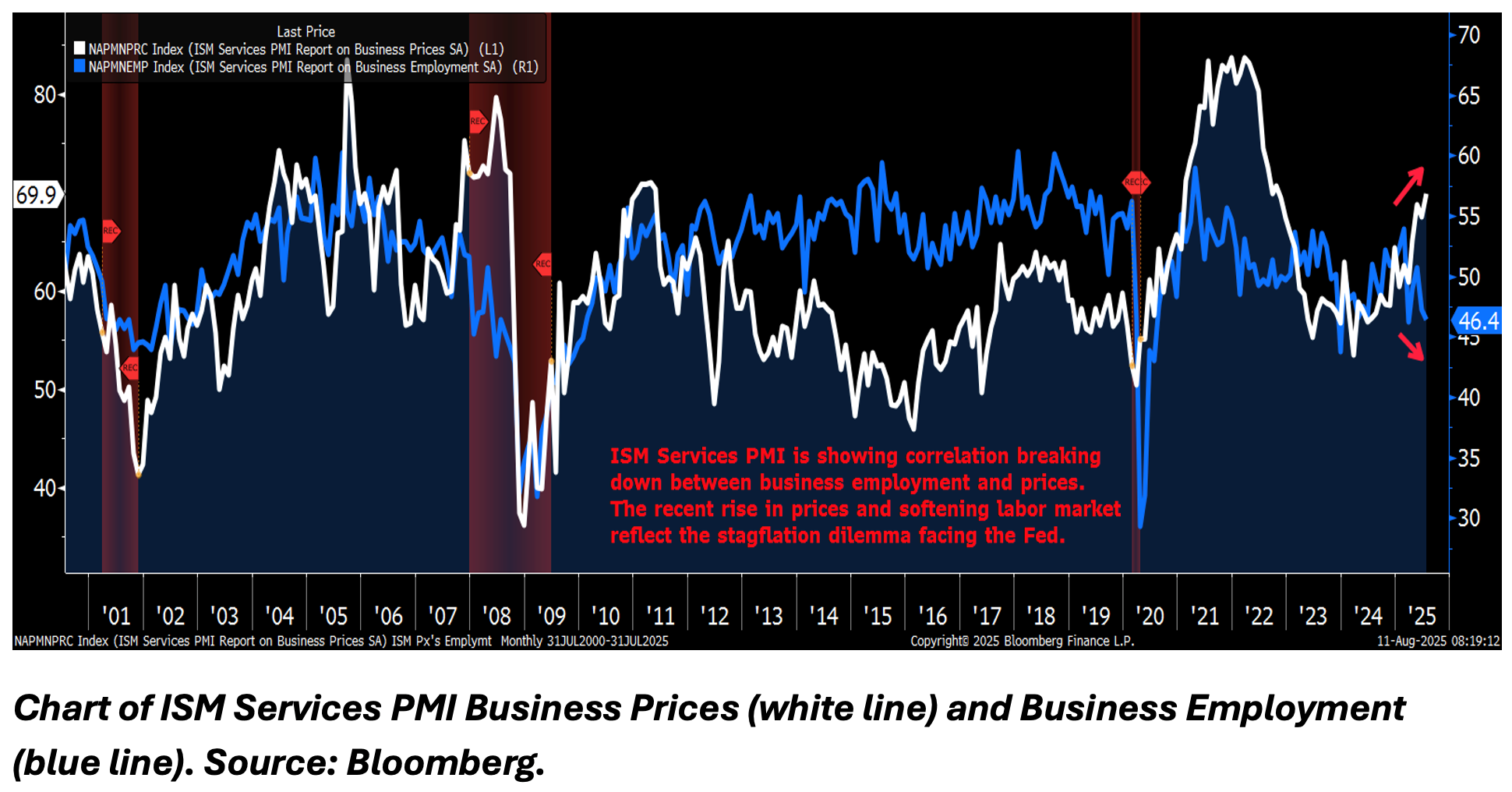

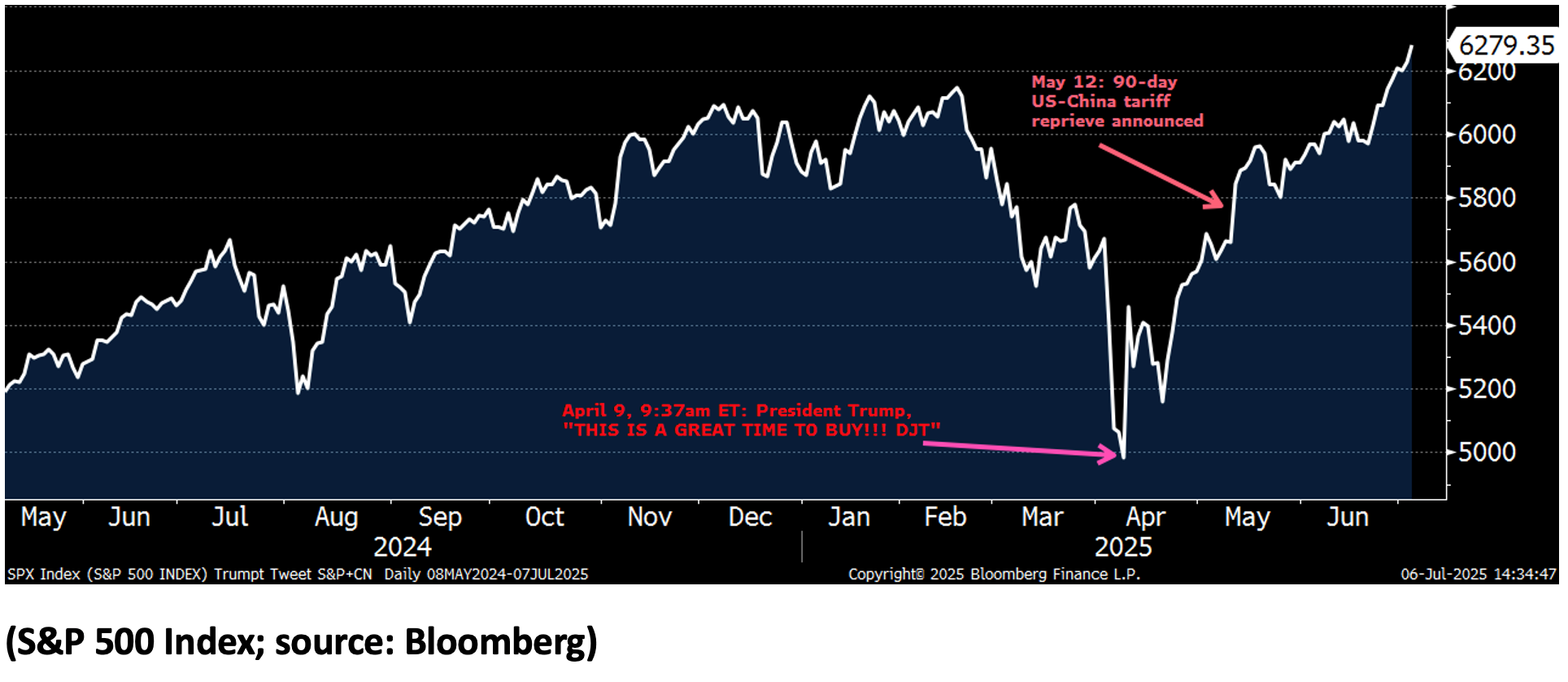

Despite concerns among some policymakers about inflation, the recent employment data strongly suggests that the general perception of the balance of economic risks is now weighted toward a cooling economy than worsening inflation. As a result, financial markets are pricing an almost certain probability of a rate cut at the FOMC’s next meeting on September 17, according to the CME’s FedWatch monitor. For markets today, the question seems to be not whether there will be a rate cut, but how large will it be? As of last Friday, markets were pricing in almost a 90% chance of a quarter-point cut, and 10% chance of a ‘jumbo’ 50 basis point cut.

For investors, the employment environment is important because it has historically correlated with equity indices and corporate earnings. A weakening job market indicates weakening economic momentum. And, according to the Bureau of Economic Analysis, consumer spending makes up approximately two-thirds of the US economy. Therefore, when job growth stalls and unemployment rises, income insecurity among US households increases, which in turn reduces consumption and business sales/profits. Ultimately, corporate stock valuations can suffer.

If history is any guide, a critical variable that will impact US equity markets during the coming year will be how the labor market continues to evolve. Last week’s nonfarm payrolls report suggests a loss of momentum in hiring. Fortunately, the economy is not yet experiencing a sustained reduction of jobs each month. Instead, the payrolls report is suggesting that there’s simply little hiring and no major, widespread layoffs as of yet. And as the labor market experiences this slowdown, markets expect the Fed to act next week with its own monetary stimulus to prevent things from getting much worse.

Paul Hoffmeister is Chief Economist and Portfolio Manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors (CEDA), and co-portfolio manager of the Camelot Event-Driven Fund (EVDIX • EVDAX).

WANT MORE WAYS TO STAY UP-TO-DATE

ON ALL THE EVENT-DRIVEN NEWS?

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B685

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2025 Camelot Event-Driven Advisors, All rights reserved.