Reviewing the Major Macro Variables

By Paul Hoffmeister, Chief Economist

· Here, in our latest monthly letter, we discuss US-China Trade, Fed and ECB policy, Brexit, the Hong Kong protests, and the 2020 elections. Given the increasingly weak global economy, the possibility grows that each could make or break the next year.

· We believe President Trump’s negotiating strategy is becoming increasingly clear, and there are more levers he can pull to pressure China to concede to US demands. Given how much further Trump can go as well as the weak Chinese economy today, the odds are rising in our view that Chinese officials will compromise on at least some major demands in the coming year. A comprehensive deal, however, is a long shot – as that arguably would entail a wholesale reformation of the Chinese economic system.

· Furthermore, we expect the Federal Reserve and European Central Bank to continue moving dovishly, and if conditions deteriorate further, they will need to do so in a big way – such as a 50 basis point cut at an upcoming FOMC meeting.

· Prime Minister Boris Johnson shocked the world with his political maneuverings recently, and the probability of Brexit by the end of October has jumped significantly.

· Hong Kong protests are a serious danger to the legitimacy of the Chinese government and the confidence in Hong Kong as an international financial center – if not during the near-term, then during the long-term.

· Elizabeth Warren is arguably the front-runner for the Democratic nomination. Managed health care stocks have been notably weak during the last month.

US-China Trade: In our view, negative news on the US-China trade front has sparked the two meaningful sell-offs of 2019. Of course, on Sunday May 5, President Trump accused Chinese officials over Twitter of renegotiating the terms of what appeared to be a tentative agreement, and so he promised tariff increases by the end of that week.[i] Then on August 1, Trump announced, again via Twitter, additional 10% tariffs on $300 billion of Chinese imports.[ii] In each instance, the new information seemed to indicate that US-China trade negotiations were devolving substantially.

This is reportedly supported by recent comments from top officials in both camps. In an interview on CNN last weekend, National Economic Council Director Larry Kudlow said he couldn’t promise a finalized trade deal with China by the November 2020 election.[iii] And according to Bloomberg this week, Chinese officials have said only a few negotiators see a deal as actually possible before then, “in part because it’s dangerous for any official to advise President Xi Jinping to sign a deal that Trump may eventually break”.[iv]

In sum, the outlook for a resolution to the US-China trade dispute is very cloudy, and a slew of tit-for-tat tariffs have already been applied by both countries, and there are many more scheduled by year-end.

President Trump continues down two parallel paths, as we see it. The first path is the effort to reach a comprehensive agreement that addresses American grievances related to forced technology transfers, IP theft, fair market access, and Chinese state subsidies to domestic businesses. Assumedly, a partial deal would be met with the removal of some, but not all tariffs. The second path is the formation of a US trading sphere so as to create two international trading spheres with the US and China at the center of each.

Today, the prospects for a comprehensive trade deal with China are poor, while two distinct international trading spheres appear to be forming.

The Trump Administration has agreed to a revised US-Korea free trade agreement (September 2018) and the new US-Mexico-Canada Agreement or “USMCA” (June 2019), which replaced NAFTA. Furthermore, the White House is working on new trade agreements with Japan, the European Union, and the United Kingdom.

It appears that a deal with Japan is getting closer to being sealed as President Trump and Prime Minister Shinzo Abe agreed to “core principles” at the recent G7 meeting. It’s possible that the deal will be finalized within the next 1-2 months. At the same time, Trump and Prime Minister Boris Johnson have spoken positively about a major US-UK deal if Brexit happens. As for a US-EU deal, Trump struck an upbeat tone at the G7 meeting, saying “We’re very close to maybe making a deal with the EU because they don’t want tariffs.”[v] With this new US-centric trading sphere taking shape, it may explain why Trump seemed so upbeat about the G7 meeting.

Given the current circumstance, we expect President Trump to keep up the significant pressure on China to force into a more reciprocal trading relationship, and the path is unlikely to be smooth.

First, Trump could still apply more economic pressure possibly by raising tariffs even higher, utilizing the Emergency Economic Powers Act of 1977 to force US companies to divest from China, or even sanctioning Chinese companies or officials suspected of human rights violations.

Secondly, as the complex negotiations continue, it’s likely we’ll hear more mixed signals from President Trump. Asked by reporters at the G7 summit about his seemingly back-and-forth and changing statements on subjects such as President Xi and Iran, the President said, “Sorry, it’s the way I negotiate… It’s done very well for me over the years, and it’s doing even better for the country.”[vi]

Bottom Line: We believe President Trump’s negotiating strategy is becoming increasingly clear, and there are more levers he can pull to pressure China to concede to US demands. Given how much further Trump can go as well as the weak Chinese economy today, the odds are rising in our view that Chinese officials will compromise on at least some major demands in the coming year. A comprehensive deal, however, is still a long shot – as that arguably would entail a wholesale reformation of the Chinese economic system.

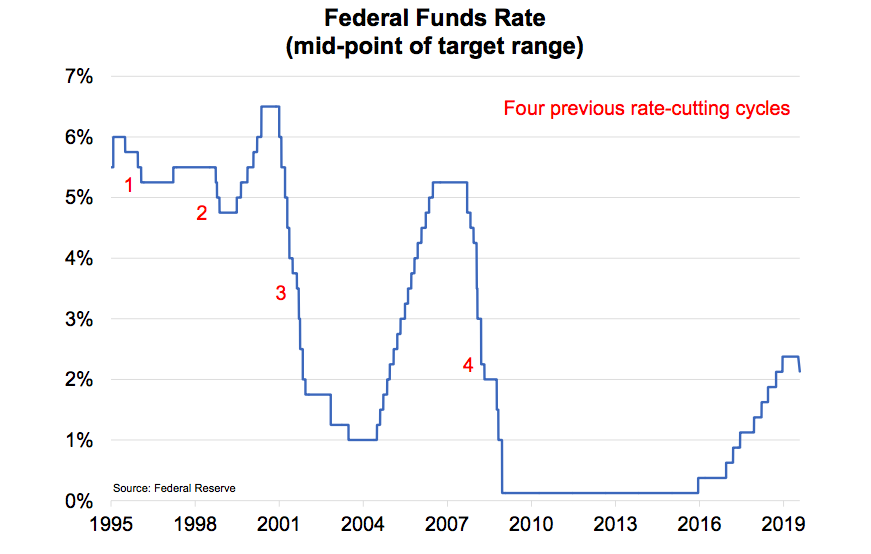

Fed Policy: There are three more FOMC meetings before year-end, with the next one scheduled for September 17-18. At that meeting, federal funds futures are currently implying a nearly 96% probability of a 25 basis point rate cut, and 4% probability of a 50 basis point cut -- according to the CME Fedwatch Tool.

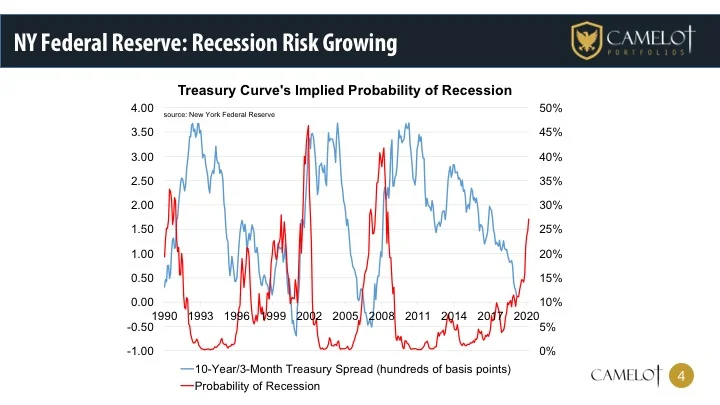

Arguably, the Fed must cut interest rates aggressively, and soon. The Fed is hostage to the market, trade negotiations, and other major macro uncertainties in the world today that are inhibiting risk-taking and production and thus slowing global economic activity. The inverted Treasury curve is another indication of the significant pressure on the Fed to cut interest rates. For example, the 3-month/2-year Treasury spread is approximately -47 basis points today, according to the St. Louis Federal Reserve. From our perspective, this implies that the market believes the funds rate is at least 50 basis points too high at the moment.

Is the inverted yield curve a signal of a looming recession? We believe that it’s an ominous signal, given its track record for preceding many recessions, and an indication of central bank error. But recession isn’t guaranteed. It’s still possible that aggressive rate cuts by the Fed and more clarity and resolution to many other macro uncertainty could re-ignite animal spirits and keep the United States from recession.

Notably, former New York Federal Reserve President William Dudley penned a highly controversial Bloomberg oped on August 27, in which he expressed a desire for the Fed to withhold interest rate reductions in order to not “bail out an administration that keeps making bad choices on trade policy”.[vii] It also appeared that Dudley went even further to suggest that the Fed pursue monetary policy into the November 2020 elections in a manner that prevented President Trump’s reelection.

But Dudley’s oped may backfire. It seems that the popular response to his oped has been critical, and ironically, may in fact turn the tables and force the Fed to prove that it isn’t acting in an “anti-Trump” manner by withholding rate cuts, but is purely economically motivated and therefore will reduce interest rates aggressively during the coming months.

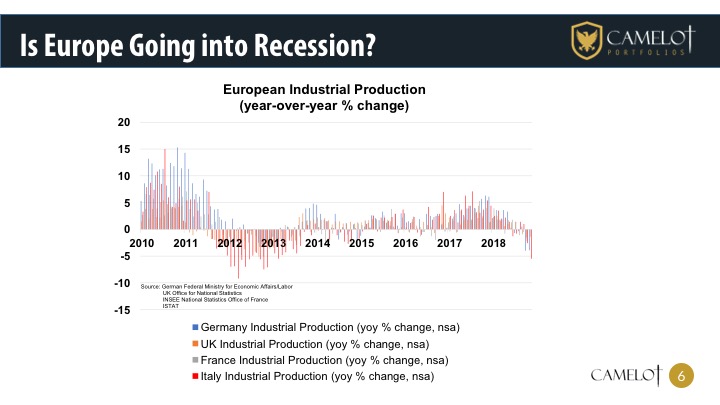

ECB Policy: At its next monetary policy meeting on September 12, it looks like the ECB will be meaningfully dovish, at least according to Olli Rehn, a member of the ECB’s rate-setting committee and governor of Finland’s central bank.

On Thursday, August 15, Rehn said, “When you’re working with financial markets, it’s often better to overshoot than undershoot, and better to have a very strong package of policy measures than to tinker.”[viii]

We believe the ECB will lower its benchmark overnight rate by 10-20 basis points from negative 0.40% currently; announce new bond purchases (“quantitative easing”); and favorably adjust loan terms for EU banks.

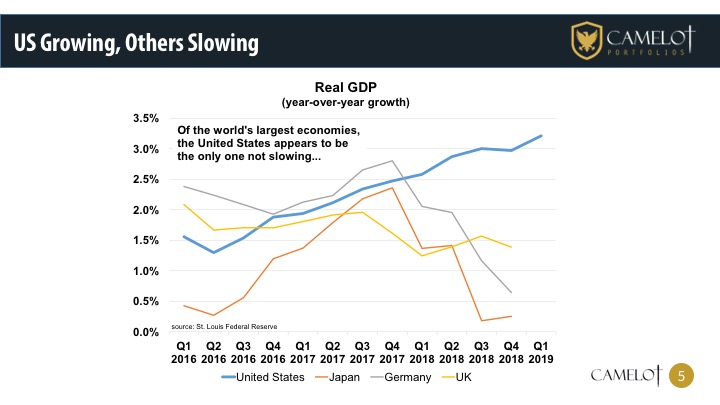

As we indicated last month, the sharpest slowdown in growth globally may be occurring in Europe. It looks like the ECB is preparing to pull out the figurative monetary bazooka in a few weeks.

Bottom Line: We expect the Federal Reserve and European Central Bank to continue moving dovishly, and if conditions deteriorate further, they will need to do so in a big way – such as a 50 basis point cut at an upcoming FOMC meeting.

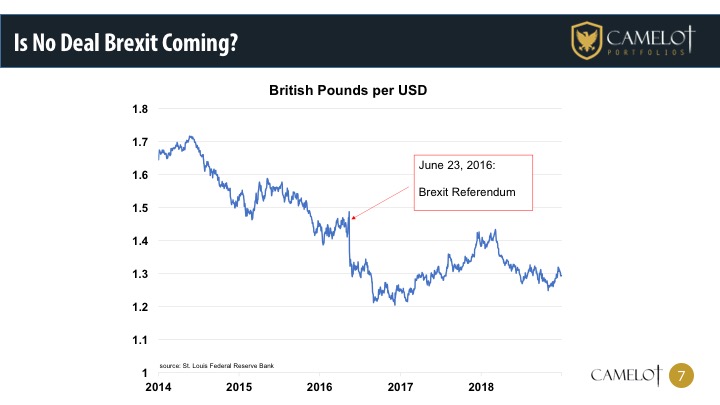

Brexit: Prime Minister Boris Johnson has famously said that he’ll achieve Brexit by the October 31 deadline “do or die”. To that end, he shocked the world on August 28 by announcing that his Parliament will be suspended sometime between September 9-12, thanks to Queen Elizabeth II’s approval. Parliament will recommence after the Queen’s speech on October 14.[ix] This will give anti-Brexiters in the legislature little time to stop a no-deal Brexit by its lawfully mandated deadline.

Interestingly, the EU Council Meeting is scheduled to take place October 17-18. It appears that there are two possible scenarios emerging here: 1) if Johnson returns with a new Brexit deal, then he’ll hope to ram it through Parliament with less than two weeks to the deadline; or 2) if Johnson does not return with a new deal, then a no-deal Brexit may automatically occur by the deadline.

In sum, the probability of Brexit has increased substantially thanks to Johnson’s crafty political maneuvering. On August 28, the Predicit market for Brexit occurring by November 1 was 58 cents on the dollar; whereas the day before, the contract traded at 48 cents.[x]

Importantly, to mitigate market volatility and economic uncertainty that could erupt with the UK’s exit from the European Union, Johnson should figure out how to quickly pass pro-growth policies, including business-friendly tax cuts and a new trade deal with the United States – both of which he has previously endorsed.

According to the Financial Times, Finance Minister Sajid Javid said two weeks ago, in his first interview since assuming his new role[xi], that he wanted to see lower taxes, but he did not commit to delivering the Johnson government’s budget proposal before Brexit day (October 31). Arguably, the Johnson government should be more aggressive here. One idea that’s been floated is lowering the UK’s corporate tax rate to as low as Ireland’s. This could be highly beneficial for the economy and markets. But, unfortunately, we haven’t heard much about it during the last month.

As for a US-UK trade agreement, at the recent G7 meeting, President Trump reiterated his desire and plan for a deal, saying “We’re going to do a very big trade deal – bigger than we’ve ever had with the UK.”[xii]

Bottom Line: Brexit by the end of October 31 is now our base case scenario, given Boris Johnson’s latest parliamentary maneuverings. We want to see a pro-growth plan, such as tax cuts and big trade agreements, implemented at the same time as Brexit transpires.

Hong Kong Protests: The protests in Hong Kong since early June continue. And, in the latest turn of events, the Xinhua news agency reported yesterday that the People’s Liberation Army (PLA) had sent a new batch of troops and equipment -- including personnel carriers, trucks and a small naval vessel – into Hong Kong.[xiii] Although this rotation of troops has been reported to be routine, the potential of a government crackdown is seemingly growing, raising the risks of unintended consequences for the Asian financial hub and the region at large.

Bottom Line: The unrest in Hong Kong is a major risk to the Communist Party’s grip on power and the region’s economies – if not during the near-term, then during the long-term.

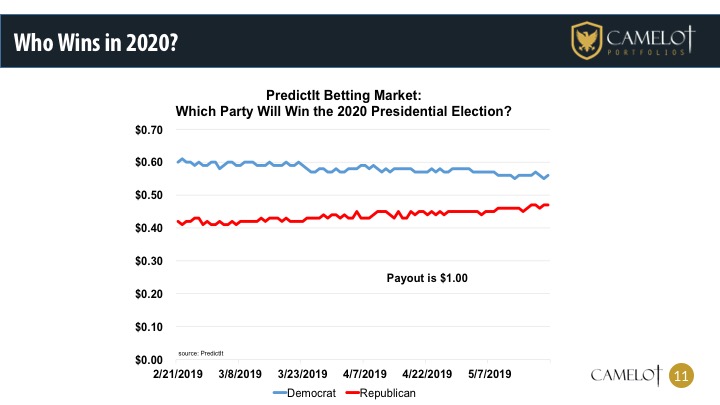

2020 Elections: Elizabeth Warren’s prospects for becoming the Democratic presidential nominee seem to be growing. In fact, she could be considered the front-runner today.

On Predictit, the contract for her to be the nominee has risen to 34 cents on the dollar, compared to 22 cents on July 30. Bernie Sanders has risen to 16 cents from 13 during that time; while Kamala Harris has fallen to 10 from 24. The contract for former Vice President Joe Biden is trading roughly flat, around 26-27 cents.[xiv]

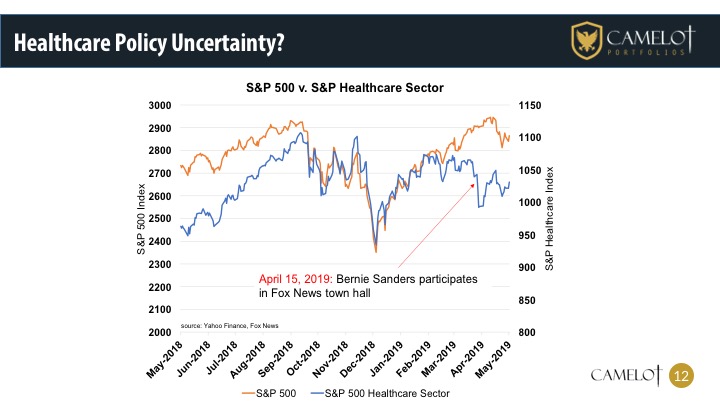

Given these betting market indications, it seems that with Warren and Sanders, the progressive wing of the Democratic Party is ascendant. And notably, with Medicare for All being a hot topic in the Democratic primaries, managed health care stocks have been especially weak during the last month. According to CNBC, the S&P 500 Managed Health Care Index fell 11.1% between July 31 and its low on August 27.

This sector may be a clear way to play bets on whether a Republican or Democrat wins the White House in 2020. We still believe, as we explained in April, that changes in American health care policy are likely in coming years, but a lot more needs to happen politically before a wholesale restructuring of the system occurs.

Bottom Line: Elizabeth Warren is arguably the front-runner to compete against President Trump for the White House in 2020. Her recent strength, as well as Bernie Sanders’s, may have spooked managed health care stocks in August.

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

*******

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

A901

[i] “Trump Says He Will Increase Tariffs on Chinese Goods on Friday as He Complains about Pace of Trade Talks”, by David Lynch, Damian Paletta and Robert Costa, May 5, 2019, Washington Post.

[ii][ii] “Trump Says US Will Impose Additional 10% Tariffs on Another $300 Billion of Chinese Goods Starting Sept. 1”, by Yun Li, August 1, 2019, CNBC.

[iii] “Kudlow Can’t Promise China Trade Deal by November 2020, But Says Big Announcement Coming”, by Nick Givas, August 25, 2019, Fox News.

[iv] “China Prepares for the Worst on Trade War After Trump’s Flip-Flops”, by Peter Martin, Kevin Hamlin, Miao Han, Dandan Li, Steven Yang and Ying Tian, August 27, 2019, Bloomberg News.

[v] “Trump Sees Possible US-EU Trade Deal That Would Avert Car Tariffs”, by Jeff Masonl and Paul Carrel, August 26, 2019, Reuters.

[vi] “’Sorry, it’s the way I negotiate’: Trump Confounds the World at Wild G-7”, by Gabby Orr, August 26, 2019, Politico.

[vii] “The Fed Shouldn’t Enable Donald Trump”, by William Dudley, August 27, 2019, Bloomberg.

[viii] “ECB Has Big Bazooka Primed for September, Top Official Says”, by Tom Fairless, August 15, 2019, Wall Street Journal.

[ix] “Boris Johnson Just Took a Huge Step to Ensure Brexit Happens on October 31”, by Matt Wells, August 28, 2019, CNN.

[x] Source: Predictit.org

[xi] Sajid Javid Promises a Simpler Tax Regime”, by Sebastian Payne, August 17, 2019, Financial Times.

[xii] “After Brexit, a U.S. Trade Deal”, Wall Street Journal Editorial, August 28, 2019, Wall Street Journal.

[xiii] “China Sends Fresh Troops into Hong Kong as Military Pledges to Protect ‘National Sovereignty’”, Weizhen Tan, August 29, 2019, CNBC.

[xiv] Source: Predictit.org