Markets, the Coronavirus and Joe Biden

By Paul Hoffmeister

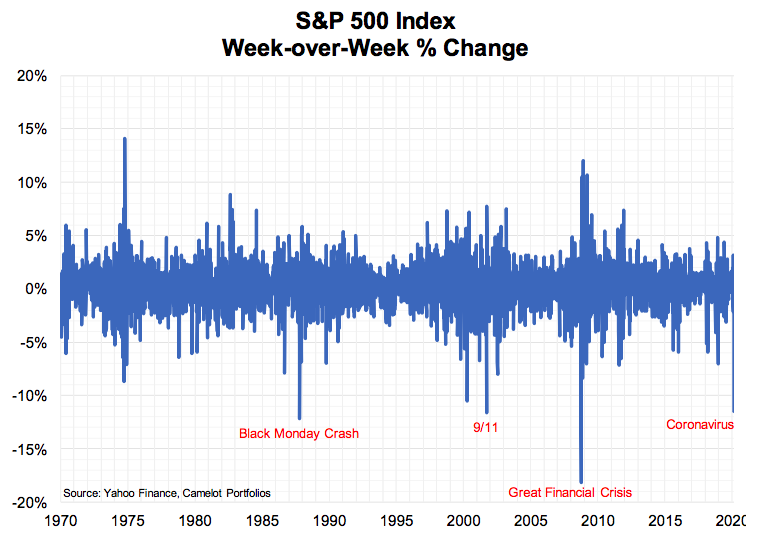

The week of February 24, 2020 will go down in history. The S&P 500’s 11.5% selloff for the week, caused by panic over the Coronavirus, was the fourth worst week-over-week loss for the index since 1970, just behind the week-over-week selloffs during the 2008 Financial Crisis, the October 1987 stock market crash, and the 9/11 terrorist attacks.

What appeared to spark the selloff were reports of viral outbreaks in Italy, South Korea and Iran. In Italy, it was reported that over 200 people had been infected, and at least 10 towns with a population of nearly 50,000 were locked down.[i] In South Korea, the total number of confirmed cases had jumped to more than 800, and the country raised its infectious disease alert to its highest level.[ii] And in Iran, total confirmed cases jumped to almost 50.[iii] The sudden case increases in these countries raised concern that the efforts to contain Covid-19 in Southeast Asia had failed, and that the world was now at the brink of a global pandemic.

Very likely, we’re already there. On Tuesday March 3,, Dr. Anne Schupat, the principal deputy director at the CDC, testified before Congress that the virus had already met two of the three main criteria under the technical designation of a pandemic.[iv] She added, “If sustained person-to-person spread in the community takes hold outside China, this will increase the likelihood that the WHO will deem it a global pandemic.”[v]

It may well be taking hold. Notably, on Wednesday February 26, the CDC reported in California the first incident in the United States of “community transmission” where an infected person was not exposed to anyone known to have been infected with the Coronavirus.[vi] The virus may in fact be more widespread than the official data is currently showing. With testing for the virus now rapidly increasing around the world, it’s likely that we will see a surge in confirmed cases that will meet the conditions for this outbreak to be classified as a global pandemic.

So, as investors, where do we go from here? How do we navigate a variable whose outcomes are highly uncertain and difficult to measure?

Arguably no one can guess how exactly the virus will evolve from here. That would be pure speculation. But perhaps the recent events in China can give us clues about how to think about the next few months, specifically with regard to the spread of the virus and the degree of any US equity selloff.

What may be exceedingly useful is the fact that it appears China is in the late innings of working through the virus, while the rest of the world is in the early innings. According to the World Health Organization, the Coronavirus is now spreading faster outside China. The number of confirmed cases outside mainland China exceeded 10,000 on March 3, compared to 80,300 in China; with 80% of new cases coming from Italy, Iran and South Korea.[vii]

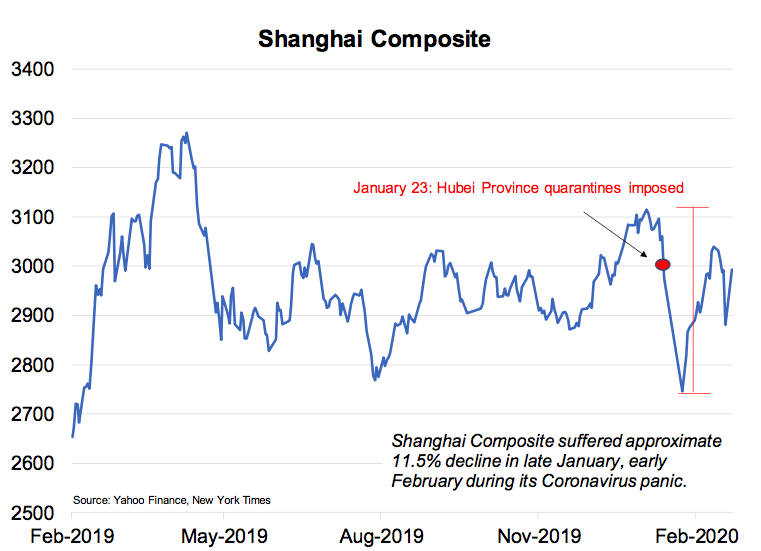

If we use January 23, 2020 (when the Chinese government imposed a lockdown in many parts of Hubei Province) as the start date, then perhaps we can say that it took China 1.5 months, at most, to succeed in controlling the virus.

Considering that China reportedly imposed extreme measures to contain the virus, including bounties, the utilization of its government surveillance apparatus, and widespread quarantines, it’s possible that the rest of the world will require at least 1.5 months to control the virus and slow its infection rate.

And what about US stocks? Will they crash more than they already have?

Between its high in mid-January to its low in early February, the Shanghai Composite sold off approximately 11.5% during its Coronavirus panic. And its rebound since then, has been fairly sustained. This is likely due to China’s success in containing the Coronavirus. It almost certainly helped, too, that the Chinese government implemented major monetary and fiscal policy measures, including interest rate cuts, the easing of loan terms to small and midsize businesses, and tax cuts.

It’s worth noting, as we mentioned last month, that we estimated the impact of SARS on the S&P 500 in 2002-2003 may have been as much as an 11% decline in the S&P 500.

These data points suggest that, with the S&P 500 -- as of March 3, 2020 -- being down nearly 11% from its highs, U.S. equities could find a bottom soon. I’m optimistic that it will, if it hasn’t already.

But, of course, this will likely be dependent on whether we see progress by authorities to contain the virus. Consequently, equity markets outside China during the near-term will likely be driven by headlines related to the containment and treatment of the virus.

Markets will also be reacting to any major, pro-growth economic measures; the exact features of which should determine the shape and slope of any market rebound, assuming the virus outside China is contained during the next couple months.

So far, the Federal Reserve has reduced the federal funds rate target by 50 basis points. Will it cut again soon? According to CBOE interest rate futures, the market is currently expecting nearly three more quarter point rate cuts by year-end. That’s ON TOP of the recent 50 basis points.

In addition to this monetary stimulus, will the White House and Congress work together to implement new tax cuts? If so, the exact tax cuts will mean everything. Will Larry Kudlow get the dream tax cut package that he and many other supply-siders have advocated for a long time: the indexation of capital gains for inflation? Or will any tax cut package be something more palatable to Democrats, such as a payroll tax cut or increased federal spending?

Economic Impact: Thinking about the Near-Term and Long-Term

Markets are suggesting that the economic cost of the Coronavirus will be massive. According to the Bloomberg Global Market Capitalization Index, global financial markets have lost nearly $10 trillion in value since their high in January, or nearly 11%. In my estimation, this may translate into a 50 basis point reduction in global GDP in 2020.

Notwithstanding the near-term GDP implications, the virus will likely have a major long-term impact on the global economic landscape, especially in accelerating the shift in supply chains away from China, as companies seek to diversify their suppliers and sources of material.

Also, the health crisis will likely mobilize more policymakers in Western countries to force certain manufacturing back into their home countries in the name of national security. While many headlines have highlighted potential supply disruptions in discretionary items such as electronics and household goods, other more non-discretionary goods are dangerously at risk of being in short supply in the West. For example, just yesterday, the Indian government restricted the export of 26 active pharmaceutical ingredients in an effort to stem possible drug shortages domestically.[viii] While many see the Coronavirus as something that we will get through, its implications will endure for many years to come.

Another Macro Implication from the Coronavirus: the November Election

Another macro implications to consider during this Coronavirus panic is whether it will have implications for the November elections. At one point last week, according to Rasmussen, President Trump suffered a 5-point drop in his approval rating (from 52% to 47%). This happened the day after his Wednesday February 26 press conference focused on the Coronavirus. Furthermore, for the week, between Monday February 24 and Friday February 28, the President’s reelection probability in Predictit betting markets declined from 59% to 55%. While President Trump remains the betting market favorite to win in November, there are clear indications that this virus poses a serious threat to his candidacy.

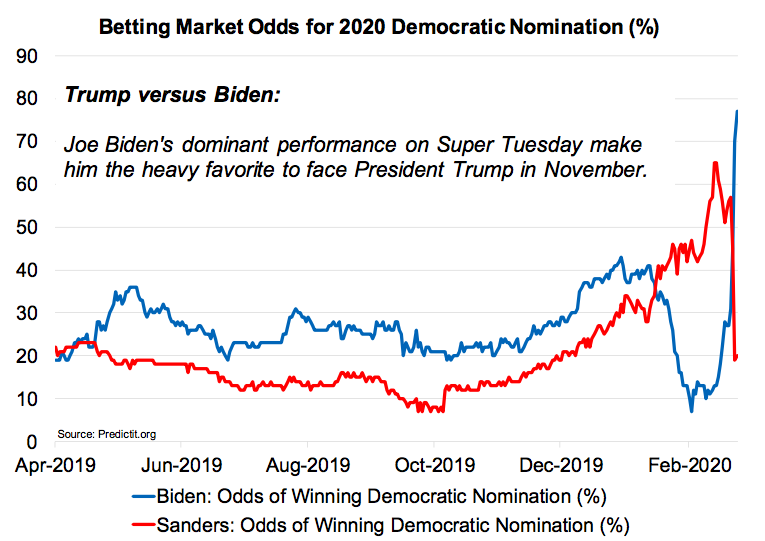

Meanwhile, the betting market on the Democratic presidential nominee is almost as erratic as stocks are these days. Today, the morning after the Super Tuesday primaries, Predictit bettors are giving Joe Biden a 77% chance of winning the nomination. Bernie Sanders’s chances have plummeted to 20%; a huge collapse from 60+% last month. It appears the turning point for Biden was his resounding win in the South Carolina primary as well as big surprise victories in Texas, Massachusetts and Minnesota. Clearly, the endorsements by Peter Buttigieg and Amy Klobuchar prior to Super Tuesday helped consolidate the moderate Democratic vote behind Biden; while Elizabeth Warren’s decision to stay in the race split the progressive vote from Sanders. Given how deeply divided the Democratic Party has been between moderates and progressives, perhaps the obvious path to build a bridge between both wings would be a Biden-Warren ticket. Predicit betting markets, however, have Kamala Harris as the current odds-on favorite to win the VP nomination at 20%, with Warren at 12%.

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

*******

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified

[i] “Coronavirus: Italy reports 7 dead, 229 infected as Europe braces for COVID-19,” February 24, 2020, CNBC.

[ii] Ibid.

[iii] Ibid.

[iv] “Top CDC official tells Congress coronavirus almost qualifies as a global pandemic,” by Berkeley Lovelace Jr., March 3, 2020, CNBC.

[v] Ibid.

[vi] “In U.S. and Germany, Community Transmission Is Now Suspected,” February 26, 2020, New York Times.

[vii] “U.S. Coronavirus Infections Rise as Cases Outside China Pass 10,000,” by Jennifer Calfas and Jing Yang, March 3, 2020, Wall Street Journal.

[viii] “Europe ‘panicking’ over India’s pharmaceutical export curbs: industry group,” by Neha Dasgupta and Ludwig Burger, March 4, 2020, Reuters.