A Race Against Time?

By Paul Hoffmeister

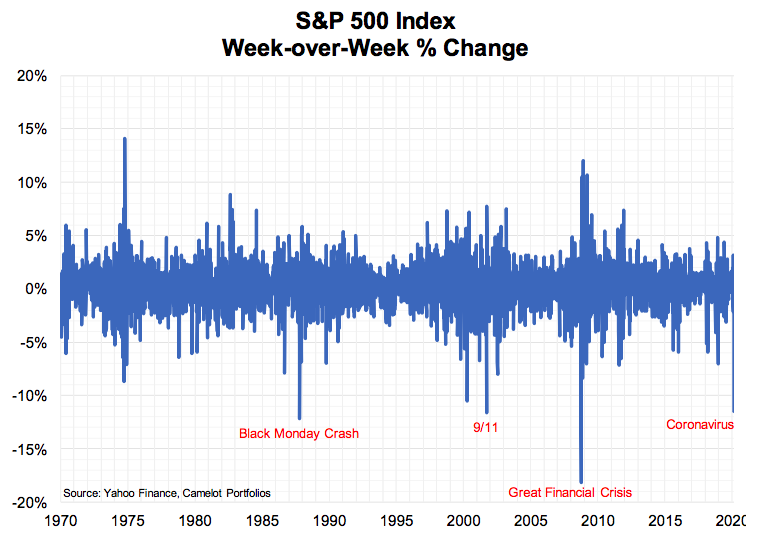

The 20% decline in the S&P 500 Index in the first quarter was the index’s worst first quarter performance in history, and its ninth worst calendar quarter performance ever. Most of the other major quarterly declines coincided with the Great Depression, the Black Monday crash of 1987, and the 2008-2009 Financial Crisis. Financially, the panic today is on par with some of the worst the country has ever seen. And on a personal level, too many Americans have died from this new virus, and the country is enduring a quarantine not experienced since 1918. We are, indeed, enduring a tragic moment in our country’s history.

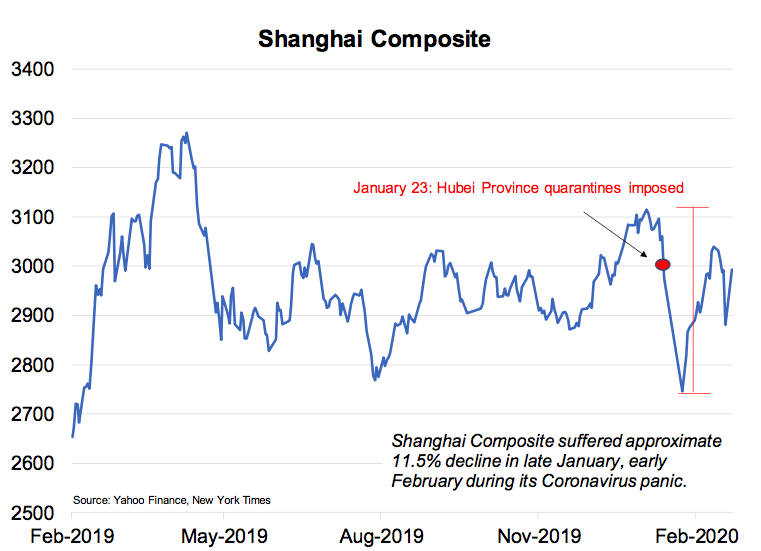

While the S&P 500 was down -8.4% in February and then -12.5% in March, the sharp selloff in stock prices really began in late February when it became increasingly clear that the small clusters of Covid-19 infections outside of China had spread to the rest of the world. Quickly, the surreal images of ghost towns and overwhelmed hospitals in the city of Wuhan became a reality for almost everyone.

A forensic examination of the recent market selloff shows that the eruptions of Covid-19 infections in Italy, South Korea and Iran during the last week of February were arguably the catalyst for the recent panic selling in stocks, as the epidemic in Asia turned into a global pandemic. By late March, the White House’s leading medical advisors, Dr. Anthony Fauci and Dr. Deborah Birx, were warning publicly that between 100k and 2.2m Americans would die as a result of this new virus.[i] To put today’s tragedy into context, the total number of Americans killed in all U.S. wars has been approximately 1.1 million, according to PBS.[ii]

Of course, to slow the spread of the virus or “flatten the infection curve”, governments aroundthe world have issued travel restrictions and stay-at-home guidelines, which has come with great economic cost. As the Wall Street Journal’s Holman Jenkins put it, nearly 83% of the U.S. economy has been suppressed to relieve the pressure on the healthcare system.[iii]

How much has this virus and the global shutdown cost? Between December 31, 2019 and March 31, 2020, the market capitalization of the world’s equity markets fell $18.5 trillion to $68.5 trillion, according to the Bloomberg World Exchange Market Cap Index.

This massive and relatively sudden haircut in market wealth makes sense given the magnitude and velocity of the current economic slowdown and surge in unemployment. We are now bracing ourselves for a 20-30% contraction in US GDP, and just last week, an unprecedented 6.5 million Americans filed for unemployment. We expect these staggering job losses to continue while most of the US economy remains closed. Former Federal Reserve Chairman Janet Yellen believes that the true unemployment rate is already 12-13%.[iv]

The critical questions for investors are, what’s being done now to manage the pandemic and economic hardship, and will equity markets return to their previous highs anytime soon?

Aside from an aggressive effort to ensure the availability of healthcare equipment and therapies for the most stricken hot spots in the country, the federal policy response has been focused on providing temporary economic relief to individuals and corporations to weather the pandemic. The policy response has been politically down-the-middle, with a lot of temporary spending and credit measures.

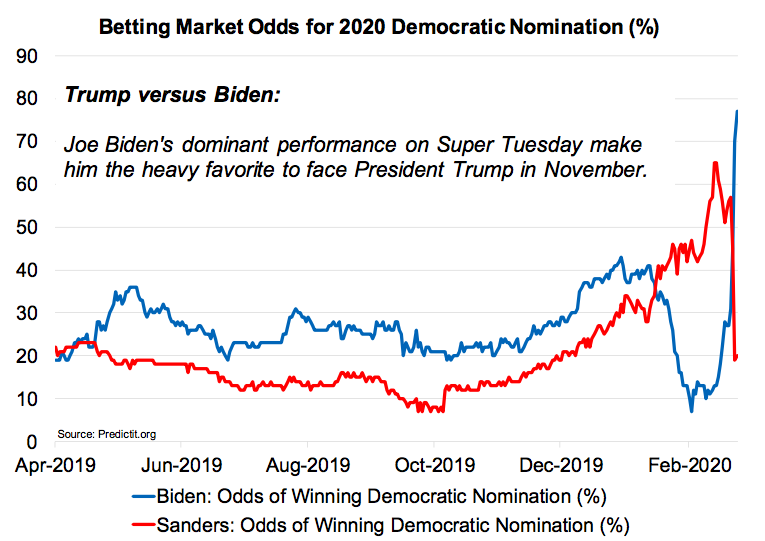

The progressive left will be disappointed that no major, relatively permanent social safety net structures have been instituted (such as new broader, long-lasting federal healthcare programs), while the pro-growth right will be disappointed that no permanent improvements in economic incentives have been created (such as sharp tax rate reductions). This policy response is perhaps the only realistic outcome of a Republican-controlled White House and Democratically-controlled House.

Notwithstanding, recent spending and credit programs have been massive. By the end of March, the White House and Congress approved the CARES Act, which will provide more than $2 trillion in economic relief -- the largest economic package ever passed by Congress. Included in the legislation are $1200 payments to most Americans, nearly $350 billion in partially forgivable loans to small businesses and non-profits, and $500 billion for the Treasury and Federal Reserve to provide liquidity and purchase corporate, municipal and state debt.[v] Reportedly, the Trump Administration is negotiating another $2 trillion dollar bill focused mainly on infrastructure spending.

In addition to these fiscal measures, the Federal Reserve among many other things slashed the federal funds rate from its 1.50%-1.75% target range to 0%-0.25% (we’re back to a zero interest rate policy or “ZIRP”), reduced the discount rate to 0.25% and attempted to destigmatize direct borrowing from the Fed, eased regulatory constraints to support lending to households and businesses, and established special facilities to steer credit directly to non-financial corporations.

In our view, the monetary policy response to the current economic crisis has been much faster and more aggressive than in 2008, and the Fed appears to be acting much more in the traditional fashion of a lender of last resort.

To be clear, the federal government’s fiscal and monetary measures today are arguably relief measures, as opposed to stimulus measures. They are policies to assist the broad economy in enduring the trillions of dollars in costs associated with Covid-19 shutdown. This will certainly help many individuals, and financial and non-financial institutions temporarily weather the crisis. But soon, if not already, the economy will need revenues restored.

This means that the economy and financial markets will either improve or devolve during the next few weeks and months based on the spread of Covid-19, the availability of therapeutic and preventative remedies, and the reopening of the economy. Quite simply, financial markets need the spread of the virus to slow, viral treatments to show clear and conclusive efficacy, and the economy to reopen.

Although there is a long way to go, there appears to be light at the end of the tunnel.

As of Tuesday April 7, China reported no new deaths, case numbers in European hotspots Italy and Spain were declining, and fatalities in New York appeared to be plateauing.[vi] As a result, we have seen lockdown restrictions lifted in Wuhan; Austria and Denmark plan to gradually lift restrictions next week; and while the U.S. still appears to be in the acceleration phase of infections, the White House is already crafting a plan to reopen the U.S. economy in the coming months.

As Larry Kudlow, director of the National Economic Council, said yesterday, “We are coming down, I think, the home stretch, that’s what the health experts are telling us.”[vii] Kudlow suggested that the economy will be begin to reopen within four to eight weeks.

A crucial step to reopening will be scaling up testing capabilities in order to better identify infected people and isolate them. Most likely, small towns that are far away from hotspots will be the first to reopen and implement extensive testing and viral surveillance programs. Undoubtedly, progress in therapeutic medicines and the widespread distribution of testing kits are critical today, for public health and the market outlook. Most parts of the economy will not be able to fully reopen without the necessary medical supplies and testing kits.

Defeating Covid-19 and reopening the economy couldn’t happen soon enough for markets. And perhaps the clearest case for that in financial markets is the credit market stress that currently exists. Credit spreads are “blowing out” faster than anything we’ve seen in recent history, and could be headed to 2008-2009 severity levels. There is a wave of corporate defaults on the horizon. The question is, will it be a size typical of periodic storms or a gigantic tsunami?

Given the nature of the federal policy response, which is mostly temporary and palliative, the economy may be in a race against time before either the previously believed once-in-a-multi-generation financial crisis of 2008-2009 happens again, or the federal government needs to step once more with additional capital to bear the burden of the massive economic cost of this pandemic.

How the next four to eight weeks play out is purely speculative. No one can forecast this kind of uncertainty. I am hopeful that human ingenuity will beat Covid-19. Sadly, it has cost the world dearly, in lives and treasure – so far nearly 90,000 deaths[viii] and tens of trillions of dollars. If the virus is not contained quickly and the economy does not reopen at least gradually, the federal government will need to step in again, quickly and aggressively. Unfortunately, we may only have a few weeks. Without question, we need the positive developments of the last week to continue. Evidence that the progress has temporarily stalled could mean the difference between a huge recovery rally and another bout of financial market panic.

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

*******

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

[i] “Dr. Birx predicts up to 200,000 U.S. coronavirus deaths ‘if we do things almost perfectly,’ by Ben Kesslen, March 30, 2020, NBC News.

[ii] “How many Americans have dies in U.S. wars?” by Megan Crigger and Laura Stanthanam, May 27, 2019, PBS.

[iii] “Questioning the Clampdown,” by Holman Jenkins, March 17, 2020, Wall Street Journal.

[iv] “Janet Yellen says second quarter GDP could decline by 30% and unemployment is already at 12-13%,” by Jeff Cox, April 6, 2020, CNBC.

[v] Source: www.whitehouse.gov

[vi] “Asian shares rise, echoing Wall Street optimism on virus battle,” by Yuri Kageyama, April 7, 2020, SFGate.

[vii] “Trump Team Preps Plans to Reopen Economy That Depend on Testing,” by Mario Parker, April 7, 2020, Bloomberg.

[viii] Source: Center for Systems Science and Engineering (CSSE) at Johns Hopkins University.

B011