by Paul Hoffmeister, Chief Economist

Let’s create context for what’s led us to where markets are now to help create a framework for how they might evolve during the next 12-24 months. To some, markets might seem a little boring recently. For example, equity markets are generally trending higher, and bouts of weakness are relatively temporary. But these are times when, to others, markets are uncomfortable. Are things “too quiet”? There are a list of important things happening underneath the surface: notably in relation to Covid, the Fed and taxes – not to mention the political outlook.

Market Crash and Recovery

In February and March 2020, Covid-related travel bans and business closures correlated with panic in stock markets.

Beginning in late March 2020, new information about the segments of the economy reopening as well as aggressive monetary policy (zero interest rate policy and bond buying) correlated with the equity market recovery.

It appears that by the last week of March 2020, the worst fears were priced in and hopes emerged that at least some of the economy would reopen, at least in a limited way.

The 2020 Covid crash could be considered the third financial crisis of the last 20 years, at least for the United States. The speed and degree of the Covid panic and recovery typify the latest crisis.

At one point in 2020, the S&P 500 was down nearly 30% year-to-date; the Nasdaq down nearly 24%... The S&P 500 returned over 16% by year-end 2020; the Nasdaq over 43%.

Today, the State of Union is strong.

In recent months, the US economy is experiencing the strongest activity in the manufacturing and services sectors of the last decade, from the perspective of ISM data.

The U.S. unemployment rate is now below 6%, compared to almost 13% during the Covid crisis (and 3.8% prior to the global shutdowns).

Equity market volatility has recently been near a pandemic low.

Risk-taking in credit markets has rarely been stronger during the last 15 years, at least in terms of the spread between Moody’s Baa and Aaa-rated corporate credit.

There is some concern about the recent jump in inflation. Inflation spikes are not uncommon after economic crises. If gold prices stay calm, then we aren’t too concerned. We believe that the amelioration of supply chain bottlenecks will help the inflation environment stabilize.

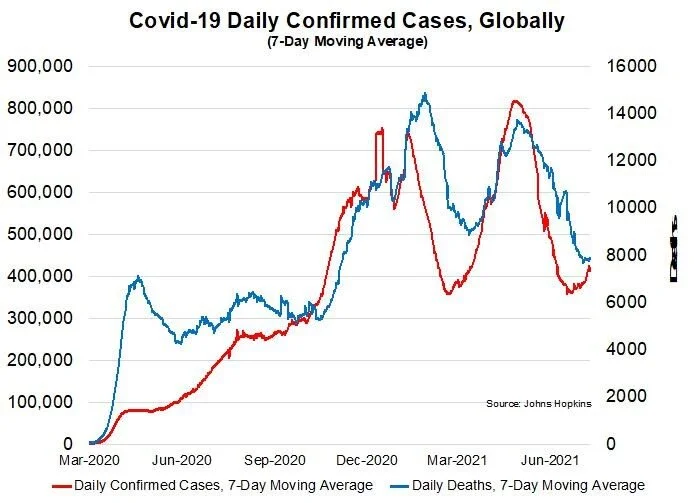

But what to worry about today? First, as we have seen during the last 18 months, the Covid pandemic and the economic shutdowns/reopenings have been a key driver of financial markets.

Will the recent uptick in Covid numbers lead to renewed lockdowns and business restrictions?

In June 2021, some Federal Reserve policymakers began to seriously discuss the timeframe for raising interest rates. In 2018, the Fed’s interest-rate hiking outlook was arguably the primary driver of the market panics that year. Will the Fed delicately and adeptly handle any departure from its current ultra-dovish policy?

The Biden Administration is working with Congress on legislation to undo the 2017 corporate tax cuts (from 35% to 21%).

It’s possible that the U.S. statutory corporate tax rate will be raised to 25-27% in the coming months.

U.S. equities appeared to react favorably in 2017, early 2018 to corporate tax cuts. To us, it seems that the rescinding of some of those cuts will lead to a flat equity return environment or some weakness.

Kamala Harris’s prospects to be the Democratic presidential nominee in 2024 have worsened since early June, as her odds have fallen in the Predictit.org betting market.

The worsening in her probabilities appears correlated with her trip to Central America.

At the moment, former President Trump is the front-runner to be the Republican presidential nominee in 2024. Governor Desantis is slightly behind him as the next likely candidate.

DIAL IN FOR OUR MONTHLY

EVENT-DRIVEN CALL

Every 3rd Wednesday at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B248

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2021 Camelot Event-Driven Advisors, All rights reserved.