by Paul Hoffmeister, Chief Economist

Monetary Policy Concerns: The aggressive interest rate hiking cycles by the Federal Reserve and the European Central Bank to combat inflation are negatively impacting their economies and will likely have unintended consequences.

Bullish Sentiment: Many bulls believe that the labor market and GDP remain strong, the 2023 equity rally will expand beyond tech giants, many stocks are attractively priced, and a Fed pause will ignite risk-taking and market indices.

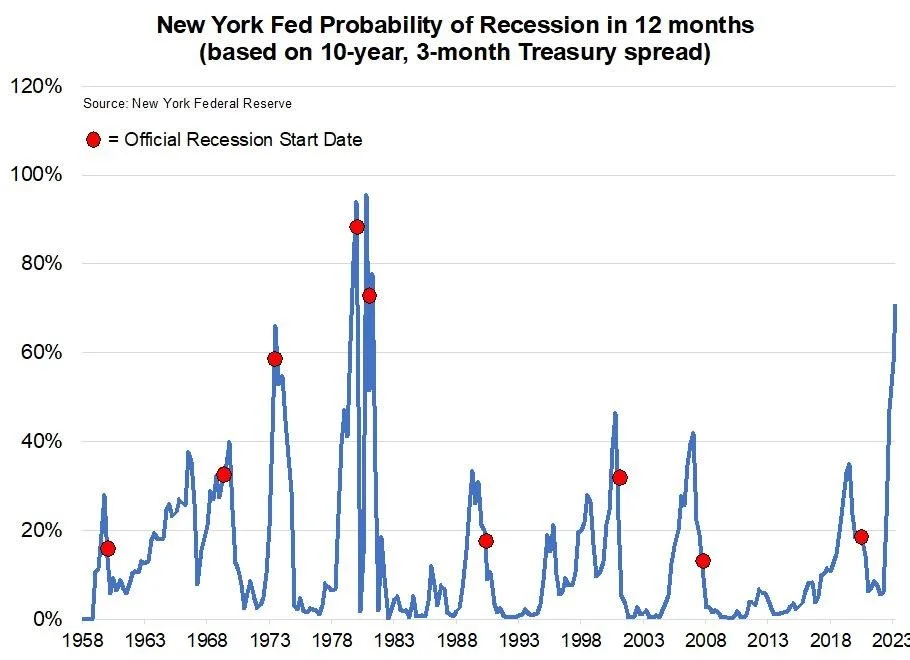

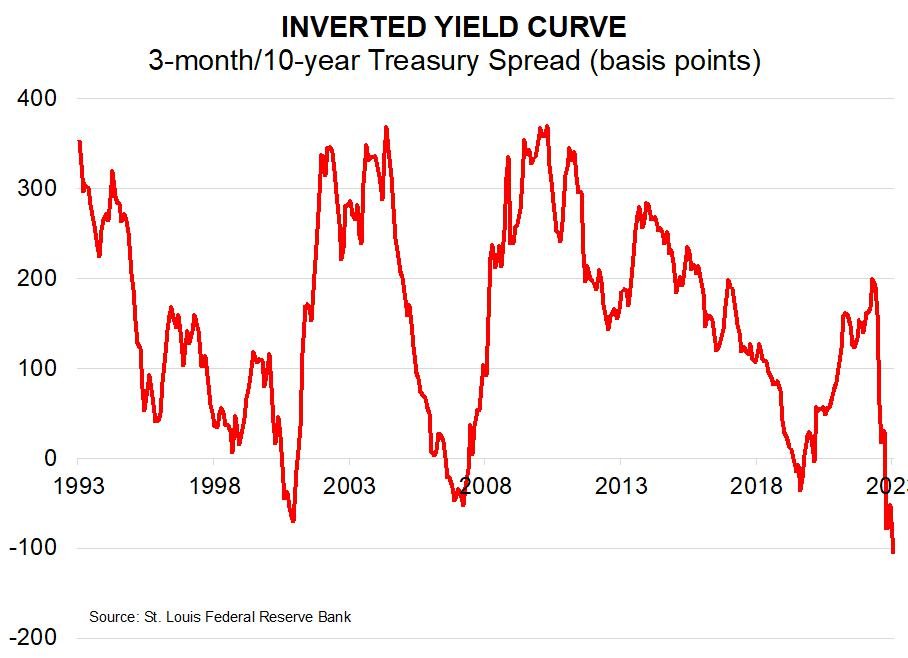

Historical Comparison: Unlike the Fed pause in 1995 by Alan Greenspan, which set the stage for a strong period for financial markets, the current situation differs as the yield curve has meaningfully inverted, indicating significant macroeconomic risks and the likelihood that the Fed has already overdone it.

Economic and Financial Challenges: Several current economic and financial challenges include consumer distress due to rising costs and high debt levels, corporate distress with manufacturing sector contraction and bankruptcies, commercial real estate market issues, tightening lending conditions, China's economic struggles, and Europe's slowdown.

Stranglehold on Growth: We conclude that major Western economies are currently stuck in a "stranglehold" due to central bank policies aimed at controlling inflation. Yield curve inversions and signals of an impending recession should not be ignored, and a shift towards interest rate cuts are likely necessary to address the current economic challenges.

Camelot’s cautious view about the current financial and economic environment is due in part to the brute force use of interest rate policy by the Fed and ECB during the last year to combat inflation. The primary purpose of today’s interest rate shock is to slow economic growth, through something called the ‘monetary policy transmission mechanism’, to reduce general price pressures. It’s a blunt tool that often creates unintended consequences, and we don’t believe this time will be different.

Notwithstanding, the popular mood today is arguably bullish. The predominant case among bulls seems to be that the labor market and GDP remain relatively strong; the financial crisis is behind us (the failures of SVB, Credit Suisse and others occurred in March); the equity rally of 2023 will broaden from a small handful of mega tech companies to the rest of the market; stocks are actually attractively priced (Bank of America recently suggested that excluding the ‘Magnificent 7’ mega-cap tech stocks, the rest of the S&P 500 is trading near 15x earnings); and the Fed pausing its rate hiking campaign, soon if not already, should set stocks free to the upside.

This is seemingly a compelling case. Indeed, Alan Greenspan surprised many by terminating his aggressive rate hikes of 1994 in early 1995, marking the beginning of a historic period for financial markets over the next 5 years. No one knows the future, of course, and perhaps we’re witnessing the beginning of another historic bull run. But what makes today different is that Greenspan stopped raising rates well before the Treasury curve inverted; and the inverted yield curve today strongly suggests to us that serious macro risks exist and the Fed has overdone it. Greenspan’s deft maneuvering in 1995 earned him the title of ‘the Maestro’.

To be specific, when Greenspan signaled an end to his rate hiking cycle in early 1995, the spread between the 10-year Treasury and 3-month T-bill was positive – more than 100 basis points; today it is negative at more than -115 basis points. The difference is equivalent to a major rate cutting cycle of at least eight quarter point reductions.

As we see it, the interest rate shock of 2022-2023 along with high inflation and a general absence of new incentives for risk-taking have created a long list of serious economic and financial problems, such as consumer, corporate and commercial real estate distress, tighter lending conditions, property market distress and a manufacturing recession in China, and general economic malaise in Europe.

In the following, we comment briefly on each, and conclude that the combination of these variables and the current macroeconomic policy trajectory don’t bode well.

Consumer distress: Consumers are ‘stretched’. The San Francisco Federal Reserve has estimated that US households accumulated unprecedented excess savings during the pandemic. By March 2023, households held $500 billion of the $2.1 trillion in total accumulated excess savings. Fed researchers now expect that balance to be drawn down to zero by the end of this month. Making matters worse, consumers are carrying the most credit in history. With both the cost of living and interest rates rising, the consumer situation is increasingly precarious.

Corporate distress growing: Manufacturing appears to be the center of the economic slowdown right now. According to the ISM Purchasing Managers Index (PMI), the U.S. manufacturing sector has been contracting each month since November 2022. According to Bloomberg, last month was the busiest August for corporate bankruptcies on record since 2000. While the ISM Services PMI is indicating growth this year, with the exception of a brief contraction last December, we believe that the persistent contraction in the manufacturing sector will likely lead to a more sustained contraction in the services sector.

Commercial real estate distress and the “doom loop” scenario: As the Wall Street Journal’s Shane Shifflett and Conrad Putzier explained last week, the commercial real estate market is now in “meltdown” due in part to high vacancy rates and falling prices. They report that banks’ total exposure to the market is nearly $3.6 trillion. Shifflet and Putzier make clear: “The banks are in danger of setting off a doom loop scenario where losses on the loans trigger banks to cut lending, which leads to further drops in property prices and yet more losses.”i We expect more banking system stress driven by the deterioration in the quality of their commercial real-estate assets.

Tightening lending conditions: Bank underwriting standards have already been tightening in recent quarters while loan demand is declining; a dynamic similar to the last three recessions. Less credit extended into the economy is less “juice” for risk-taking and economic growth.

China: China’s once- booming property market is in distress; it’s manufacturing sector is contracting; and investment is slowing. According to the United Nations in 2019, China accounted for nearly 30% of global manufacturing output – the leader by a significant margin. Chinese exports declined -14.5% year-over-year in July and -8.8% last month. If China is indeed “The World’s Factory”, then its health is arguably a worrisome barometer of the health of the global economy.

Europe on Brink of Recession: The ECB recently raised its main refinancing rate to 4.25%, from 0% in July 2022. The probability of further rate hikes is unclear given that euro zone growth is expected to slow to 0.8% this year, according to the European Commission. Germany has already entered recession.

As we see it, the macroeconomic summary today is of a vulnerable consumer, contracting manufacturing that will likely beget a slowdown in services, major risks to the banking system from the commercial real estate sector, less credit availability, and a struggling China and Europe. While we’re seeing a marginal policy response by the Bank of China aimed at supporting some sectors in that country, the Fed and ECB are focused on a ‘higher for longer’ policy prescription to keep a chokehold on growth and wring more inflation out of the system. In other words, the major western economies are stuck in a stranglehold for the time being.

The apparent incongruence today between US and European monetary policies and the macroeconomic environment may explain why the yield curves for the major Western economies are each experiencing inversions that are unprecedented for the last few decades. What do these deep and liquid sovereign debt markets know or fear? The yield curve’s prescience during previous interest rate hiking cycles and recessions should be respected rather than ignored. We believe that signals of impending recession are all around us and most probably occurring first in Europe at large; while at the same time serious financial risks are accumulating ever so slowly. The ‘Maestro’ response today would be to surprise with interest rate cuts. Maybe as many as eight quarter-point cuts. If not now, we believe that markets will eventually force it upon the Fed.

i “Real-Estate Doom Loop Threatens America’s Banks,” by Shane Shifflett and Conrad Putzier, September 6, 2023, Wall Street Journal.

DIAL IN FOR OUR QUARTERLY

EVENT-DRIVEN CALL

3rd Wednesday of every quarter at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2023 Camelot Event-Driven Advisors, All rights reserved.