by Paul Hoffmeister, Portfolio Manager and Chief Economist

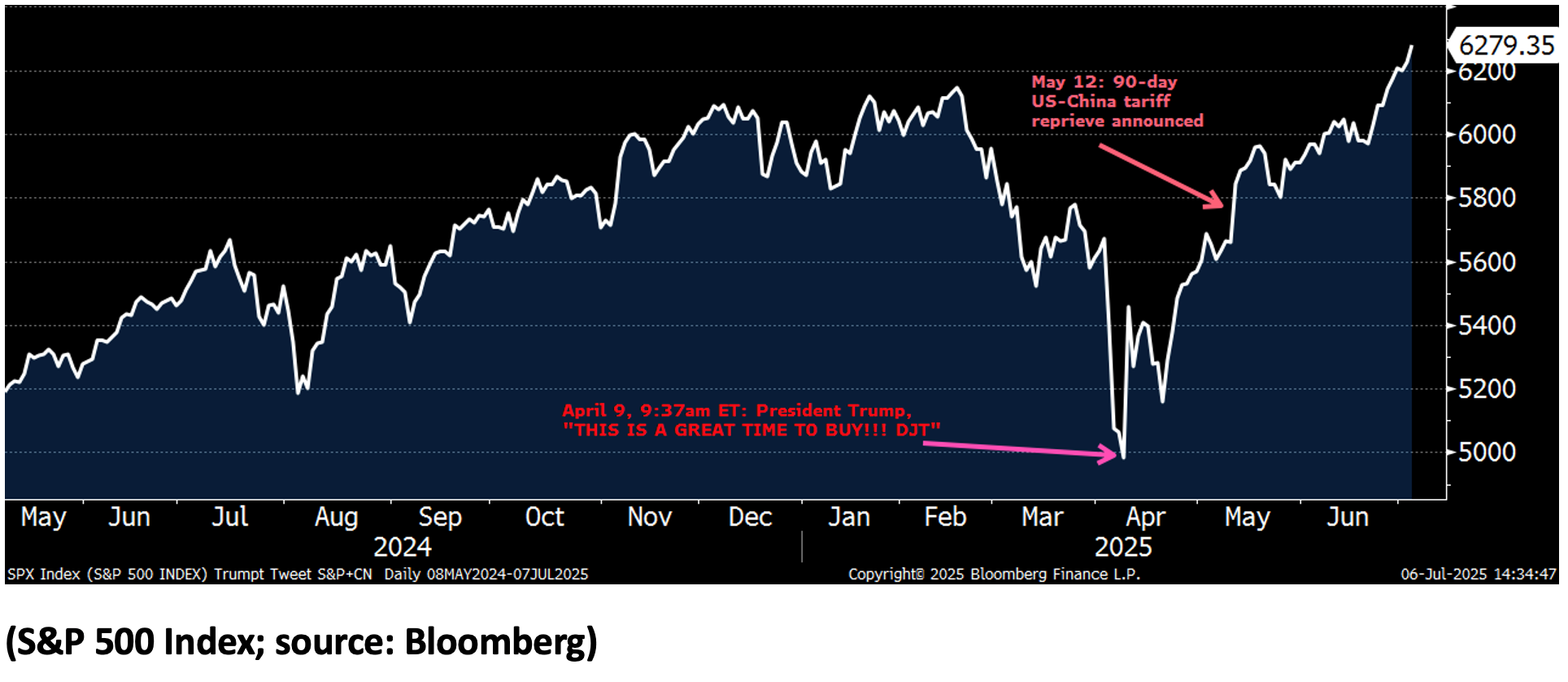

The S&P 500 is up nearly 25% since April 9 when President Trump announced in his now-famous Truth Social post that it was a “…great time to buy!!!” Less than four hours later, the President revealed a 90-day pause on the increased reciprocal tariffs that he unveiled the previous week while leaving in place a 10% baseline tariff. Of course, stocks sold off during the first week of April after those country-specific tariffs (some as high as 50%) were announced. The about-face after one week calmed panicked markets and set the stage for the recent, massive rally.

Some could easily forget that in his April 9 post the President imposed a 125% tariff on Chinese imports into the United States, while other countries were given the temporary reprieve. But concerns about US-China trade relations were eased on May 12 after negotiations in Geneva led the United States and China to reduce for 90 days their import tariffs to 30% and 10%, respectively, while further negotiations were held. That news helped catalyze the second leg higher in the recent stock market recovery. Helping matters further, on June 11, the President posted on Truth Social: "Our deal with China is done, subject to final approval from President Xi and me."

Equity markets seem to be very pleased these days, as the S&P 500 makes record highs. Not only have significant tariffs been avoided, but the President signed into law major tax reform on July 4.

As we explained last month, the latest budget bill is imperfect from a supply-side, pro-growth perspective as it needed to be scored budget-neutral within reconciliation rules and compromises were required between pro-growth and austerian wings of the GOP. Notwithstanding, the bill has important growth-stimulative components, such as permanently lower tax thresholds (which were passed in 2018 and scheduled to expire in 2026) and 100% bonus deprecation rules.

If any pro-growthers want another chance at reducing taxes on businesses and capital (such as lower corporate and capital gains taxes), then they’ll need to make a stronger case to the country and win stronger electoral mandates in the future. This could be similarly said for austerians, such as Elon Musk, who want to see more done to keep federal spending under control. For his part, Musk has filed documents with the FEC to form a new political party.

The near-term market focus will likely now shift to the expiring tariff-related deadlines. The initial 90-day pause is set to expire on July 9, and the China-specific pause expires on August 14.

It’s unlikely that tariffs will be reinstituted as early as July 9. On Sunday, Treasury Secretary Bessent explained on CNN that letters were being sent to trading partners outlining the Administration’s trade and tariff expectations, and that country-specific tariffs will revert on August 1 to their April 2 levels if deals weren’t reached. Effectively, there seems to be a three-week extension during what seem to be final deal-making stages. Commerce Secretary Lutnick added on Sunday that "…the president is setting the rates and the deals right now."

As for a US-China trade deal, Chinese officials seemingly downplayed notions of a “done deal” in June. At the time, a spokesperson for China’s Ministry of Commerce characterized the outcome of those meetings as a “framework” to implement the general agreement reached in May. The agreement includes access to magnets and rare earth minerals for the United States, and chip design software and jet engine components for China. According to the Wall Street Journal, both countries are thus far easing some of their respective export controls.

In general, the trade-related news appears constructive but not yet definitive. Arguably, the absence, for now, of sky-high tariffs and retaliatory tariff walls being erected around the world have relieved equity markets and allowed them to set new highs.

Just as importantly, there seems to be a growing perception that the White House wants to avoid another market panic like the first week of April. After all, there was the policy about-face on April 9; the notable absence of public comments from the Administration’s leading trade hawks, and more market-friendly tariff messaging from the likes of Secretaries Bessent and Lutnick; as well as the latest tariff deadline extension to August 1.

This strongly suggests that the Administration is working to smooth the transition to a new, comprehensive trade regime. But the market is waiting on a lot of new trade deals. Thus far, the United States has reached agreements with the UK and Vietnam. Big deals yet to be finalized include China, the European Union, Mexico, Canada, Japan, South Korea and India.

Given the stock market’s recent reaction function, deal completions should be favorable and create more follow-through to the upside. The near-term outlook appears constructive. But a lot of optimism seems to be priced into risk assets today and a host of deals are yet to be reached, which could create short-term choppiness.

Paul Hoffmeister is Chief Economist and Portfolio Manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors (CEDA), and co-portfolio manager of the Camelot Event-Driven Fund (EVDIX • EVDAX).

WANT MORE WAYS TO STAY UP-TO-DATE

ON ALL THE EVENT-DRIVEN NEWS?

FOLLOW US ON LINKEDIN!

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B665

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2025 Camelot Event-Driven Advisors, All rights reserved.