by Paul Hoffmeister, Portfolio Manager and Chief Economist

With recent economic reports showing inflation falling and unemployment rising, the Federal Reserve appears to be on the verge of cutting interest rates before the end of the year.

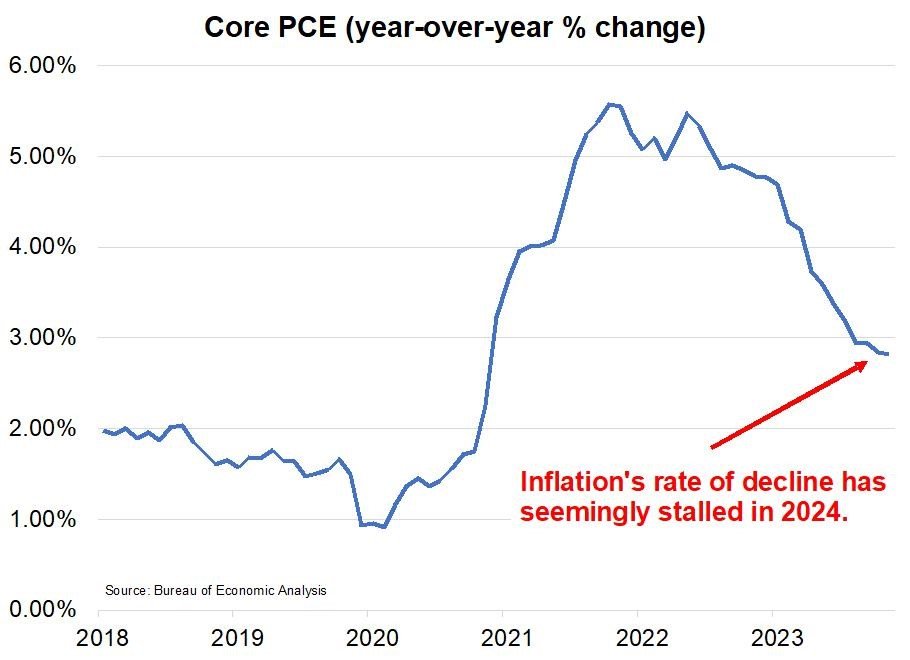

Specifically, the core PCE inflation gauge shows that as of May, year-over-year inflation rose 2.6%. Inflation pressures had been steadily declining since reaching a high of 5.5% in 2022, but stalled briefly around 2.8% early this year. Now, confidence has grown that inflation’s decline has reasserted itself and is trending toward the Fed’s long-term goal of 2%. (Bureau of Economic Analysis)

At the same time, the unemployment rate stood at 4.1% in June. After bottoming at 3.4% in early 2023, the Fed’s interest rate increases of the last two years are weighing on the economy. (Bureau of Labor Statistics)

Within the context of this recent data, Fed Chairman Powell told Congress last week that the United States is “no longer an overheated economy” and the “labor market appears to be fully back in balance”. (“US economy no longer overheated, Fed’s Powell tells Congress”, by Howard Schneider and Ann Saphir, Reuters, July 9, 2024.) As a result, the fed funds futures market expects that, by year-end, the Fed will cut the funds rate by 50 basis points from its current 5.25%-5.5% to 4.75%-5.0%.

While we believe the dovish shift at the Fed is welcome news and important for markets and the economy, the recent upturn in the unemployment rate is particularly concerning because it suggests a high probability of a looming recession.

According to the “Sahm Rule”, developed by former Fed economist Claudia Sahm, when the unemployment rate rises at least half a percentage point (0.50%) above its low point in the past year, a recession has begun. What does this rule look like today? After the recent employment data, the Sahm Rule rose to 0.43%; very close to the 0.50% threshold.

Chart of Core PCE year-over-year inflation (orange line) versus the U.S. unemployment rate (white line); recession periods highlighted in red. Source: Bloomberg.

Simply looking at the last 25 years, the recent increase in unemployment looks similar to the months before the 2001 and 2008-2009 recessions. Today, there are almost 800,000 more people unemployed compared to a year ago, and with short-term interest rates currently in restrictive territory AS WELL AS the likelihood that the lagged effects of the last two years of tight monetary policy will weigh further on the economy, there appears to be an increasingly negative momentum in the economy.

Some important questions today are how much momentum is there to the current economic slowdown? And, will the expected interest rate cuts quickly abate that momentum?

Chart of the 3-month/10-year Treasury spread (dotted white line), core PCE year-over-year inflation (orange line), and the U.S. unemployment rate (white line); recession periods highlighted in red. Source: Bloomberg.

Historically, the yield curve, especially the 3-month/10-year Treasury spread, has been a relatively useful leading indicator of economic activity. Today, it stands around -116 basis points. In our view, the story it currently tells is that an economic contraction is on the near-term horizon, and the Fed is arguably “too tight” -- by at least 100-125 basis points.

Unfortunately, it’s generally expected that the funds rate will only be reduced by about 50 basis points by year-end. And according to the FOMC’s economic projections published last month, the median expectation among policymakers is that the funds rate will fall to 3.9%-4.4% by year-end 2025, which is a year and a half away.

Putting all the clues and evidence together, it’s welcome news that the Fed appears to be on the verge of cutting interest rates in the coming months because the economy appears to be slowing. And as we see it, the forward-looking yield curve seems to suggest that today’s negative economic momentum will be significant enough to push the economy into contraction (recession); so the rate cuts couldn’t come fast enough.

Paul Hoffmeister is Chief Economist and Portfolio Manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors (CEDA), and co-portfolio manager of the Camelot Event-Driven Fund (EVDIX • EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B575

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2024 Camelot Event-Driven Advisors, All rights reserved.