by Paul Hoffmeister, Chief Economist

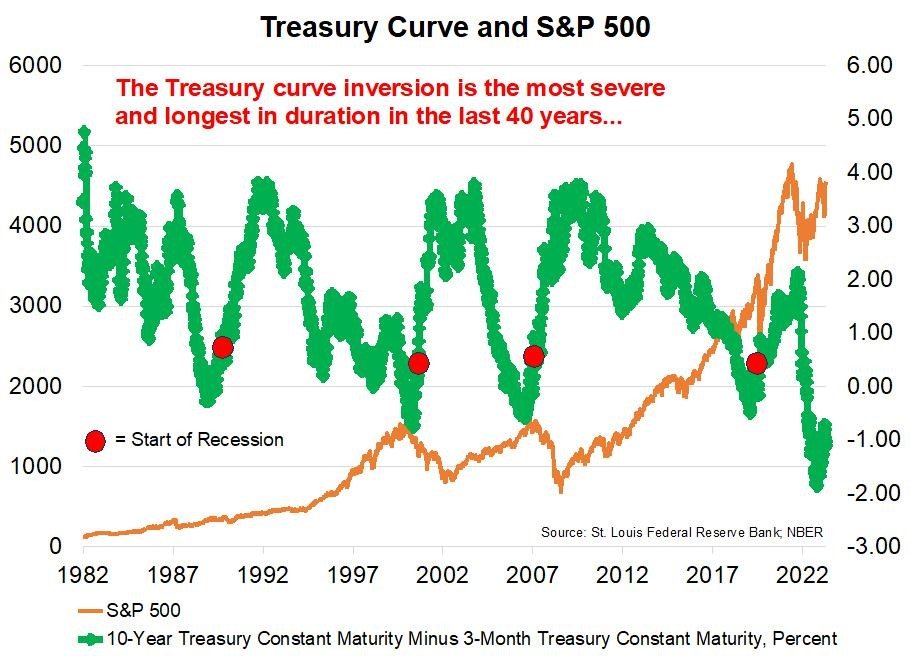

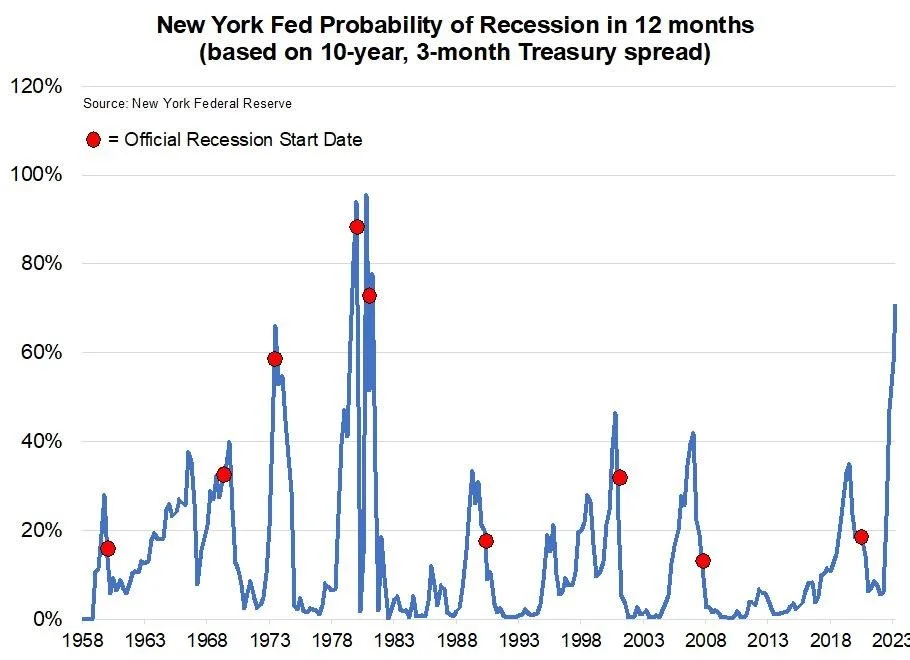

We believe the biggest question of 2024 is: what will follow today’s major yield curve inversions?

Today, the Fed is signaling a transition from rate hikes to rate cuts.

We look at the last three Fed pauses: 2000, 2006 and 2019. The precedents aren’t encouraging. Furthermore, the inverted yield curves of the major Western economies (USA, Canada, UK, France, Germany) are sending an ominous signal.

The strong labor market and relatively resilient earnings in the United States are arguably keeping stock prices strong. But economic weakness is emerging.

Biggest Question of 2024 & 2025: What Follows This Inversion?

- The previous episodes of Treasury curve inversion led to significant financial and economic harm: the 1989-1990 S&L crisis, bursting of the tech bubble, and the Global Financial Crisis -- as well as recessions on each occasion.

- Today’s yield curve is even more inverted today. We saw major bank failures in Q1 2023, but no recession in the United States. Is that the extent of the financial and economic implications of this interest rate cycle? This is arguably the most important financial question today.

Fed Transitioning From Rate-Hiking to Rate-Cutting

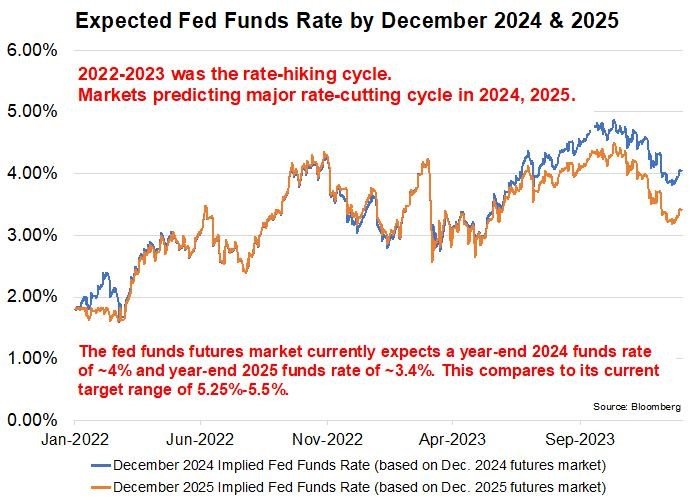

- The dovish shift in the interest rate outlook highlights that this will be a transition year, as we go from the interest-rate hiking cycle of 2022-2023 to the interest rate-cutting cycle of 2024.

- Market expectations for where funds rate will be at end of 2024 and 2025 have declined by 75 to 100 basis points since October.

- Currently, the FOMC is targeting a funds rate range of 5.25%-5.50%. The market expects the fed funds rate to be ~4% by year-end 2024, and ~3.4% by year-end 2025.

- According to the Chicago Mercantile Exchange, fed funds futures suggest that the rate-cutting cycle will begin at the FOMC’s March 20 meeting.

Inflation Falling

- What’s behind the dovish expectations that have emerged in recent months?

- Data are indeed showing a decline in inflation.

- Absent an escalation of geopolitical instability, inflation could continue to behave and give the Fed room to cut interest rates in 2024.

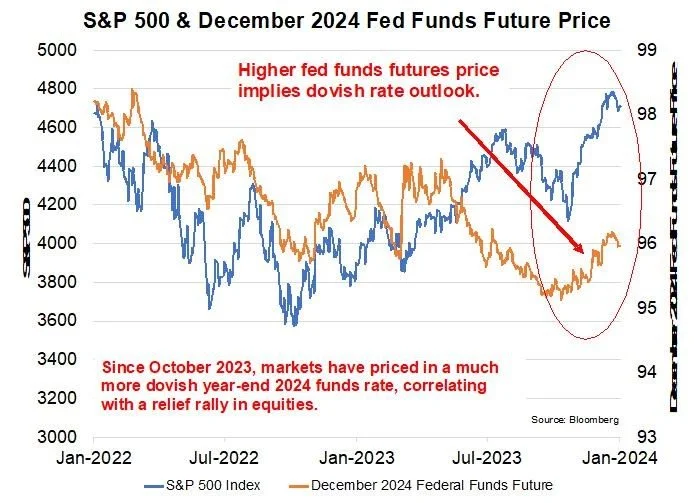

Dovish Outlook Fueled Late 2023 Relief Rally

- The S&P jumped more than 15% from its October lows to recent levels.

- Worsening Fed expectations (higher rate expectations) throughout 2022 and early 2023 correlated with weaker stock prices. But that correlation broke down for a few months starting in March 2023, most likely underscoring the importance of the Fed’s “BTFP” program intervention in response to the bank failures at the time.

Bank Stocks Outperform in Late 2023

- Bank stocks jumped more than 30% from their October lows to recent levels.

- In terms of sectors, financials arguably took the interest rate-hiking cycle the most on the chin. KRE fell more than 50% from its 2021 high to its May 2023 low.

- This is understandable. Some banks were blindsided by the Fed changing its telegraph of low rates for a long time to aggressive interest rate increases. Silicon Valley Bank, First Republic, and Credit Suisse were the notable casualties.

Dovish Re-Pricing Tightened Credit Spreads

- Another economically positive byproduct of the dovish shift in late 2023 has been the subsequent tightening in credit spreads, indicating an improvement in financing conditions and risk-taking. This should help economic growth at the margin.

Rate Cycle Transition 2000-2001

- How have equity markets previously behaved in response to a Fed pause after a prolonged rate-hiking cycle? 2000, 2006 and 2019 are the most recent precedents.

- The precedents aren’t too encouraging.

- The 2000 Fed pause was followed by equity market weakness (and coincident economic weakness due to the tech wreck) and ultimately an aggressive rate cut response by the Greenspan Fed.

Rate Cycle Transition 2006-2007

- The 2006 Fed pause was initially followed by a stock market rally. But economic weakness and aggressive Fed policy easing ultimately emerged.

Rate Cycle Transition 2019-2020

- The early 2019 Fed pause was initially followed by a stock market rally. But stock market and economic weakness eventually emerged, causing the Fed to start cutting rates in August 2019.

- Of course, in Q1 2020, the Covid pandemic catalyzed aggressive rate cuts and other monetary measures.

Stocks Holding Up So Far. Why?

- Bears were arguably wrong in 2023. Why? Today’s high government spending (that supported spending and employment) is one possible factor. As we see it, the labor market and earnings were two shoes that didn’t drop last year. Indeed, the labor market and S&P 500 earnings were seemingly irrepressible last year. But will that condition continue in 2024?

- So far, the US unemployment rate is strong at 3.7%. In the past, increases in the unemployment rate corresponded with weak stock indices.

- If the unemployment rate jumps in 2024, that will likely be a headwind for equity returns.

Stocks Holding Up So Far. Why?

- S&P 500 earnings have held up relatively well during the last year.

- However, previous inverted yield curve episodes preceded significant declines in earnings.

- History suggests that both labor markets and earnings are likely to weaken in 2024. Such a combination doesn’t bode well for equities.

Bond Markets: Ominous Signal?

- Today, many analysts are predicting that the economy will achieve a soft landing after the interest rate shock of 2022-2023.

- But the bond market might be predicting something different. Or is it?

- The government bond curves for the major Western economies (US, Canada, UK, France and Germany) are each inverted and collectively inverted to a degree we’ve never seen in recent decades.

- A pessimistic interpretation of this is that most of the global economy is headed toward a hard landing and severe recession.

- An optimistic interpretation is that the inflation outlook is rapidly improving and Fed policymakers are going to cut rates in 2024-2025, thereby engineering a soft landing.

Unemployment Turning Higher?

- Unemployment in the major Western economies are, for the most part, starting to turn for the worse. Italy is an exception.

- Previous turns in unemployment in Western economies correlated with recession, particularly in the United States.

US Employment Picture

- In the United States, we are seeing a meaningful deterioration in unemployment conditions.

- These permanent job losses are reminiscent of the early stages of the 2001-2002 and 2007-2009 recessions.

Global Manufacturing Picture

- Global manufacturing has been contracting since September 2022 – that’s 15 straight months.

US Services Sector

- US services sector is dangerously close to contraction.

- Typically, contractions in the US service sector coincide with recession.

- In 2021, the US service sector comprised ~78% of the US economy, according to Statista.

US Banking Conditions

- In his November 29, 2023 statement, FDIC Chairman Martin Gruenberg stated: “…the banking industry again proved to be resilient in the third quarter. After excluding non–recurring accounting gains in the first half of 2023, net income would have been roughly flat for the past four quarters at a level considered high by historical measures. In addition, overall asset quality metrics remained favorable and the industry remains well capitalized. However, the banking industry still faces significant challenges from the effects of inflation, rising market interest rates, and geopolitical uncertainty. These risks, combined with concerns about commercial real estate fundamentals, especially in office markets, as well as continued pressure on funding levels and earnings, will be matters of continued supervisory attention by the FDIC.” (source: FDIC: Speeches, Statements & Testimonies - 11/29/2023 - Remarks by FDIC Chairman Martin Gruenberg on the Third Quarter 2023 Quarterly Banking Profile)

In Conclusion ...

Today, the 10-year/3-month Treasury spread is the most inverted it has been since the early 1980s. Furthermore, the sovereign curves of the major Western economies are simultaneously inverted, to significant degrees, casting a worrisome signal of economic prospects.

Global manufacturing is weak, US manufacturing is contracting, and the US service sector appears to be on the verge of contraction. At the same time, unemployment rates for many of the major Western economies appear to be turning higher. The confluence of these variables suggest that many countries are entering recession.

The Fed is signaling an end to its recent interest-rate hiking cycle and the likelihood of rate cuts in 2024. The Fed rate pauses of 2000, 2006, and 2019 didn’t preclude subsequent economic and equity market weakness.

DIAL IN FOR OUR QUARTERLY

EVENT-DRIVEN CALL

3rd Wednesday of every quarter at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B529

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2024 Camelot Event-Driven Advisors, All rights reserved.