by Paul Hoffmeister, Chief Economist

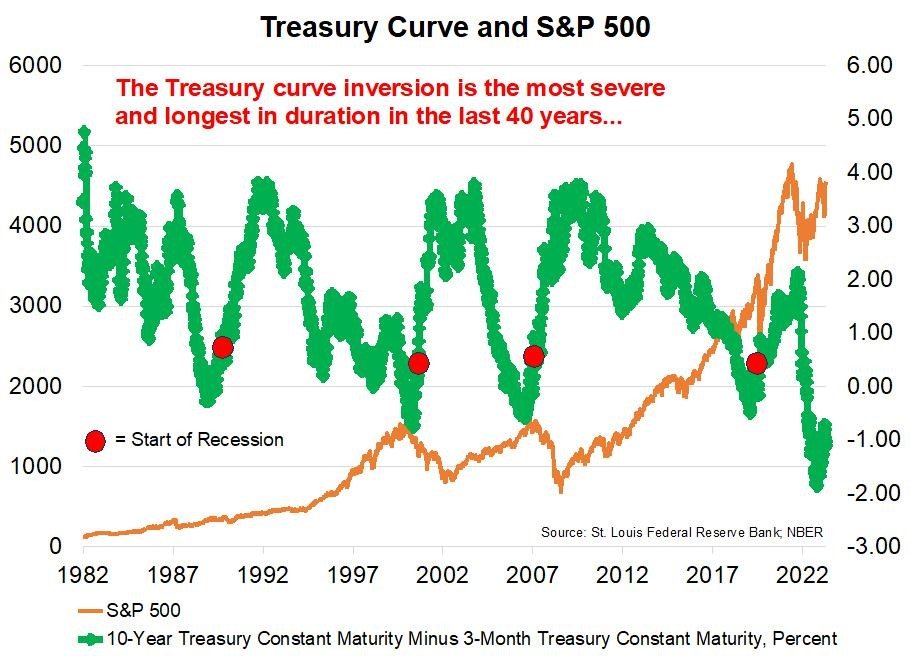

Treasury curve most inverted since 1980’s.

Longest period of inversion since 1980’s.

Russell 2000 has significantly underperformed the S&P 500 and Nasdaq QQQ since banking problems last March; arguably a sign of flight to safety and weakening economic fundamentals.

Cooling labor market tends to correlate with weak equity performance.

Two big financial stories of 2023 are the inverted yield curve and the strong returns in large cap stocks. The first is an ominous signal, and the second doesn’t seem too encouraging for the economic outlook.

First, the yield curve. We’re currently witnessing the most inverted Treasury curve since the early 1980’s; not to mention, since then, the yield curve has never been inverted for this length of time.

When looking at the economic history, the inversions that have occurred during the last 4 decades have preceded recessions every time. Specifically, there have been four episodes of inversion, and after each, a recession occurred (with start dates in 1990, 2001, 2007, and 2020). When we assess today’s yield curve alongside other economic indicators, as we’ve laid out in previous client letters, we believe that history will repeat itself and recession will begin in 2024.

Notwithstanding the worrisome outlook that Treasury bonds are suggesting, there is a lot of talk that there will be “no landing” or a “soft landing”; i.e. a recession will be avoided or it’ll be shallow. One of the most popular arguments is the strength of the stock market this year. The S&P 500 is up nearly 19%, and the Nasdaq QQQ’s more than 35%. Indeed, these year-to-date gains in the major indices are impressive. But if we “zoom out”, we get a little better context of what might be happening.

The strong equity returns are not broad-based. Instead, the strength tends to be weighted in large caps and technology. The small cap Russell 2000 Index is up just 7% this year.

As we see it, the outperformance of large cap tech stocks may be a flight to safety in an increasingly precarious economic environment. Furthermore, the stark underperformance by small and more economically sensitive companies isn’t the sign of a vibrant, healthy economy, but rather the sign of weakening economic underpinnings that, in its early stages, is most noticeably impacting the more vulnerable. In terms of vulnerability, Apollo currently estimates that nearly 40% of Russell 2000 companies have negative earnings.

What’s most noteworthy about the stark difference in stock market performance between large and small caps is the timeline of the divergence in their performance. When the prospects of Fed rate increases began to emerge in early 2022, both tended to perform somewhat “in sync”. But this behavior appears to have broken down since March 2023 when banking problems emerged in the United States and Europe (with the failures of Silicon Valley Bank on March 10 and Signature Bank on March 12, and the takeover of Credit Suisse on March 19). Since the collapse of Silicon Valley Bank on March 10, the S&P 500 has soared nearly 18% and Nasdaq QQQ 33%, while the Russell 2000 has returned almost 6%.

These market internals are more worrisome than heartening, and suggests to us that deeper risks are brewing, and perhaps the banking problems last spring were the early casualties of the current downturn in the business cycle.

As we’ve outlined in recent months, we believe some of the major macro risks today are the real estate crisis and financial risks in China, economic slowdown in Europe (Germany is already in recession), the consumer squeeze, tighter lending conditions, geopolitical risks (Ukraine, Middle East, and Taiwan), and the implications of the weakening commercial real estate sector on banks.

Indeed, weeks ago, FDIC Chairman Martin Gruenberg neatly summarized the risks posed by commercial real estate:

…deterioration in the [banking] industry’s commercial real estate portfolio is beginning to materialize in office properties, in which weak demand for space, softening property values, and higher interest rates are affecting the credit quality of underlying loans. Total noncurrent non–owner–occupied commercial real estate loans increased 36.4 percent from last quarter, and the noncurrent rate for these loans is the highest since third quarter 2014. Higher interest rates pose risks for other commercial real estate properties as well, as maturing fixed–rate loans will need to be renewed at what are now much higher market interest rates.

In other words, noncurrent non-owner-occupied commercial real estate today is the highest in nine years, and the high interest rates today will be especially negative for these fixed-rate loans that are maturing because they’ll need to be refinanced at much higher interest rates. As a result, the risk to banks with large exposures to commercial real estate is likely to be a major story in 2024.

Based on the economic data in recent months, it appears the slowdown is underway. This was recently acknowledged by Federal Reserve Governor Christopher Waller, who cited October data indicating that consumer spending, manufacturing and non-manufacturing activity are each slowing; meanwhile the labor market is “cooling off”. Indeed, the US unemployment rate has risen from 3.4% in April to 3.9% in October.

DIAL IN FOR OUR QUARTERLY

EVENT-DRIVEN CALL

3rd Wednesday of every quarter at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B525

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2023 Camelot Event-Driven Advisors, All rights reserved.