by Paul Hoffmeister, Portfolio Manager and Chief Economist

The FOMC met on July 29-30 and voted in favor of keeping the fed funds target range at 4.25-4.5%, making the fifth consecutive pause in interest rate adjustments. The Fed hasn’t cut rates at all this year, which is in sharp contrast to the 100 basis points in cuts between September and December of last year. At one point last fall, financial markets, indicated by December 2025 fed funds futures, were expecting almost a 3% funds rate by the end of this year.

The Fed’s reluctance to reduce interest rates has clearly sparked the ire of President Trump, who is demanding fast and aggressive rate cuts. The President has nicknamed Chairman Powell “Too Late” and called him a “stubborn moron” and “numbskull”. In his view, the funds rate is at least 3 percentage points too high. The President’s criticism arguably reflects many voters, as recent Gallup surveys show that only 37% of Americans have confidence in the Fed Chairman. [1]

Based on the flat yield curve today and assuming that the long end of the curve would stay at current levels, an immediate cut of 300 basis points to the funds rate would make Fed policy as aggressively dovish as it was after the tech bubble burst (2001-2002) and the Global Financial Crisis (2009-2010).

Powell, for his part, is in an exceedingly difficult position, and the Fed is facing an almost impossible dilemma. Both sides of the interest rate debate seemingly have a compelling argument.

On the one hand, doves argue some variation of the following: the flat Treasury curve and the 2-year Treasury yield (almost 60bps lower than fed funds) are screaming that the Fed is too tight; the labor market is softening (Sahm Rule has been tripped, slowdown in job growth, rising unemployment claims, declining job openings); manufacturing has been contracting for most of the last 3 years (<50 ISM Manufacturing Index); and the services sector is on the verge of contraction (50.1 ISM Services Index for July).

On the other hand, rate hawks point to the strength in the equity markets, corporate profits, gold prices, and household net worth; along with high consumer prices and the official unemployment rate of 4.2%.

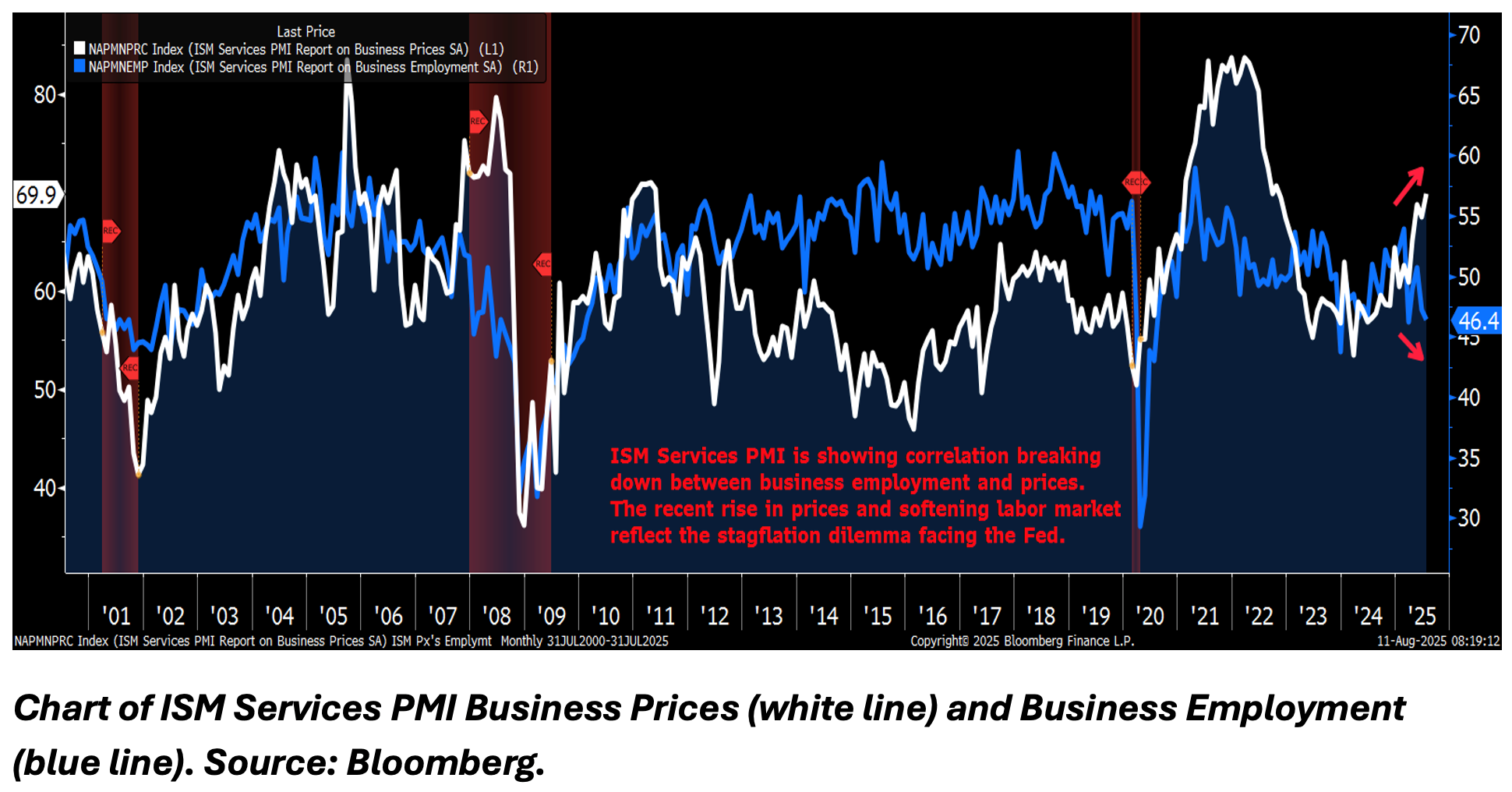

In our view, the ISM Services PMI data for July sums up the debate and dilemma. This relatively real-time data basically shows an emergent stagflation of rising inflation and weakening employment. Last month, the survey’s employment index fell to 46.4%, the fourth contraction in five months and lowest level since March. Meanwhile, the prices paid index jumped to 69.9%, the highest level since October 2022. With the service sector making up approximately three-quarters of the economy, the softening job growth and intensifying cost pressures are a worrisome trend.

Complicating matters, tariffs may be worsening the inflation outlook. A recent Federal Reserve Board working paper concluded that the China tariffs increased core-goods PCE prices by nearly 0.3 percentage points. Boston Fed research concluded that the President’s plan to impose 10% tariffs on China and 25% tariffs on Mexico and Canada would increase core PCE by 0.8 percentage points. And, Chicago Fed President Austan Goolsbee recently suggested that tariffs could raise inflation between 0.5 and 0.8 points, depending on how much those costs pass through businesses.

Muddying waters even more may be Fed credibility. It’s possible that some Fed members are inclined to cut interest rates but are concerned at the same time of being seen as caving to political pressure. Or, conversely, they could be reluctant to cut rates because of supposedly missing or failing to extinguish the inflation of 2022, where year-over-year core PCE jumped to 5.5% from 1% in 2020. These are psychological factors that may be almost impossible to accurately assess.

Fed policymaking might be an unenviable job these days. Unfortunately, these are the countless variables that factor into monetary policy decision-making when policymakers operate within a discretionary rather than rules-based system.

Notwithstanding the nature of the modern monetary regime, today’s policy debate and growing stagflation pressures, the policy bias at the Fed today is increasingly dovish. Not only did two FOMC members favor cutting rates in the last meeting, but President Trump has nominated his CEA Chairman Stephen Miran, a known dove, to the Fed Board of Governors. This has helped to push the December 2025 fed funds futures to expecting almost two quarter-point rate cuts by year-end.

If anything, Fed policy is ever so slowly moving in the direction of what market-based indicators such as the yield curve and 2-year Treasury are apparently demanding. And so, monetary policy will likely continue to evolve gradually unless extremes emerge in the future, whether it be economic or inflationary, demand more rapid action.

__________

[1] “Public Views of the Fed Chair Are Polarized as Trump Mulls His Firing”, by Ruth Igielnik, July 16, 2025, New York Times.

Paul Hoffmeister is Chief Economist and Portfolio Manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors (CEDA), and co-portfolio manager of the Camelot Event-Driven Fund (EVDIX • EVDAX).

WANT MORE WAYS TO STAY UP-TO-DATE

ON ALL THE EVENT-DRIVEN NEWS?

FOLLOW US ON LINKEDIN!

VISIT OUR FRIENDS AT EVENT-DRIVEN.BLOG

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B682

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2025 Camelot Event-Driven Advisors, All rights reserved.